10 Secrets to a 750+ Credit Score By Masters Credit Consultants

If you want a 750+ credit score, you need proven strategies that work today.Therefore, this guide reveals the 10 secrets to a 750+ credit score used by experts.Moreover, Masters Credit Consultants shows how to build [...]

What to Expect in the First 30–60 Days of Credit Repair (Real Results, Clear Timelines, No Guesswork)

What to Expect in the First 30–60 Days of Credit Repair If you are researching what to expect in the first 30–60 days of credit repair, you deserve the truth.Although early activity happens quickly, credit [...]

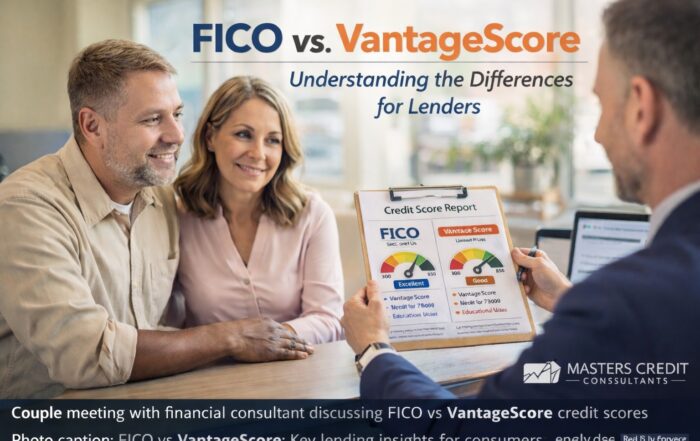

FICO vs VantageScore Model: Explained

Why Understanding FICO vs VantageScore Models Matters Today (FICO vs VantageScore model explained for real-world lending) First, most consumers see multiple scores online.However, lenders rarely view those scores equally.Therefore, understanding the difference prevents costly surprises. [...]

Decode Your Credit Report Now: What Every Item Really Means (Before It Costs You Points)

Decode Your Credit Report Now. A credit report explainer is essential if you want control over your financial future.However, most people read their credit report without understanding what the items really mean.As a result, mistakes [...]

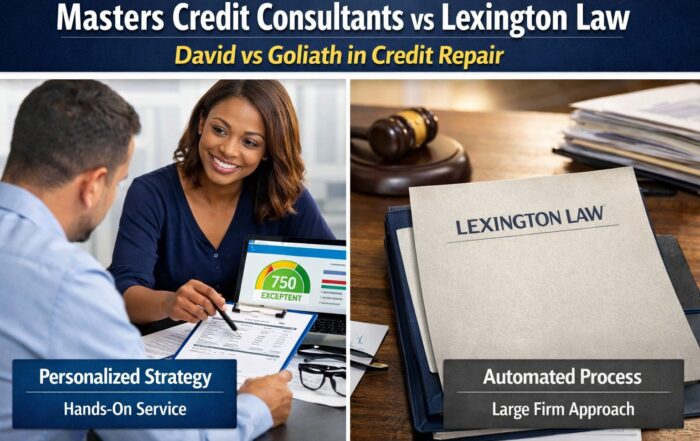

Masters Credit Consultants vs Lexington Law: David vs Goliath in Credit Repair — What Smart Consumers Must In 2026

When comparing Masters Credit Consultants vs Lexington Law, consumers often assume size equals success. However, that assumption can be costly. In reality, the David vs Goliath in credit repair debate reveals why smaller, specialized firms [...]

2026 Credit Repair Explosion: Get Your First Month FREE With Masters Credit Consultants Before This Offer Ends

The 2026 Credit Repair Explosion is officially here, and Masters Credit Consultants is launching one of the most aggressive credit repair offers of the year. If you are serious about improving your credit profile, increasing [...]