Pay for Delete Letter

A pay for delete letter is a type of settlement offer that creditors may make to consumers in order to pay off a debt.

The consumer agrees to pay the creditor a specific amount of money, and in return, the creditor agrees to delete the debt from the consumer’s credit report.

The process of negotiating and sending a pay-for-delete letter can be helpful for consumers who are struggling with debt.

By working out a deal with the creditor, the consumer can improve their credit score by removing a delinquent account from their credit history.

However, it is important to note that not all creditors will agree to negotiate a pay for delete agreement. So, it is important to do your research before trying to negotiate with your creditors.

If you are considering negotiating a pay-for-delete agreement with your creditor, it is important to remember that you should never agree to anything until you have read and understood the terms of the agreement. Be sure to get legal advice if necessary to make sure that the agreement is fair and reasonable.

Pay for delete letter template for credit repair

Credit repair can be a daunting task. Luckily, there are many resources available to help you get started. One of these is the pay-for-delete letter template.

A pay for delete letter is a tool that you can use to negotiate with your creditors in order to have negative items removed from your credit report. This can be helpful if you are looking to improve your credit score.

There are a few things that you will need to keep in mind when using the pay for delete letter template:

- Make sure that you have accurate information about the items that you want to be removed from your credit report. This includes the account number, the date of the incident, and the amount owed.

- Be polite and respectful when writing a letter. Remember that you are dealing with professionals who may be able to help you improve your credit score.

- Be clear about what you are asking for. Make sure that you list the items that you want to be removed and state that you are willing to pay the amount owed.

- Keep a copy of the letter for your records.

A pay-for-delete letter template is a helpful tool, but it is important to remember that it is not always successful.

If the creditor does not agree to remove the item from your credit report, you may need to consider other methods of credit repair.

If you’re looking to improve your credit score, using pay for delete letter template may be a good option.

This letter is used to negotiate with your creditors in order to have negative items removed from your credit report.

Keep in mind that there is no guarantee that the creditor will agree to remove the item, but it can be worth trying if you’re looking for ways to improve your credit score.

The benefits of using a pay for delete letter to improve your credit score

Your credit score is one of the most important numbers in your life. It determines your interest rates on loans, your ability to get a job, and even how much you pay for car insurance. A low credit score can haunt you for years, so it’s important to do everything you can to improve it.

One way to improve your credit score is by using a pay for delete letter. A pay for delete letter is a letter that asks a creditor to remove negative information from your credit report in exchange for payment. Usually, the payment is made in full and upfront.

There are several benefits of using a pay for delete letter to improve your credit score:

- It can help you get rid of negative information on your credit report.

- It can help you improve your credit score quickly.

- It’s a fast and easy way to improve your credit score.

- It’s affordable and easy to do.

If you’re looking to improve your credit score, using pay for delete letter is a great option. It can help you get rid of negative information on your credit report and improve your credit score quickly and easily.

Contact your creditors today to learn more about pay for delete letters and how they can help improve your credit score.

Tips on negotiating with creditors to get them to agree to a pay for delete agreement

If you’re struggling to make your monthly credit card payments, one option to consider is negotiating with your creditors to get them to agree to a pay for delete agreement.

This is where you agree to pay off your entire balance, in exchange for the creditor deleting any record of the debt from your credit report.

Before you start negotiating, it’s important to know what kind of leverage you have. In other words, what are the chances that the creditor will actually agree to delete the debt from your credit report?

One factor that will influence the creditor’s decision is how much debt you owe. The larger your debt balance, the more likely the creditor is to agree to a pay for delete agreement. Another factor is how long you’ve been delinquent on your payments.

The longer you’ve gone without making any payments, the less likely the creditor is to agree to a pay for delete agreement.

In order to negotiate, you’ll need to get in touch with your creditor and explain that you’re interested in arranging a pay-for-delete agreement. You’ll also need to provide a proposed payment plan that shows how you’ll pay off your entire balance.

If the creditor agrees to the pay for delete agreement, make sure to get it in writing. This will protect you in case the creditor later decides not to follow through on the agreement.

Paying off your entire balance might be difficult, but it’s worth considering if it means getting a clean slate with your credit report. Follow these tips to negotiate with your creditors and get them to agree to a pay for delete agreement.

What are some of the risks associated with using a pay for delete letter?

When it comes to debt, there are a lot of ways to deal with it. One option that some people choose is to use a pay-for-delete letter.

This is a letter in which you offer to pay your creditor in full if they agree to delete the debt from your credit report.

There are a few risks associated with using this type of letter. First, there’s no guarantee that your creditor will actually agree to delete the debt from your credit report.

Second, even if they do agree, there’s no guarantee that the deletion will be reported to the credit bureaus. This could mean that your credit score won’t improve as much as you’d hoped.

Finally, by using a pay for delete letter, you may be admitting that you actually owe the debt. This could make it harder to negotiate with your creditor in the future.

If you’re considering using pay for delete letter, be sure to weigh the risks and benefits carefully before making a decision.

How do I write a pay-for-delete letter?

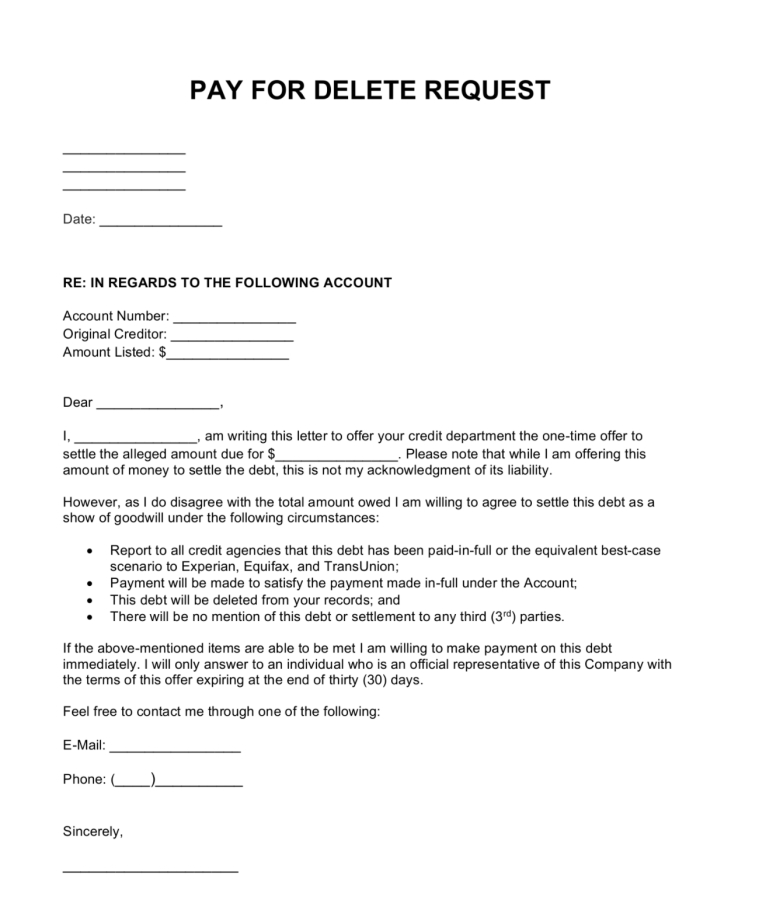

There is no one specific format for writing a pay-for-delete letter. However, the following is a general outline of what should be included in your letter:

- Your name and contact information.

- The name and contact information of the credit bureau(s) that has the negative information on your report(s).

- The account numbers associated with the negative information on your report(s).

- The date the negative information was first reported.

- A brief explanation of why you are requesting that the negative information be removed

- Your signature.

In addition, some credit bureaus may also require you to include a copy of your driver’s license or other government-issued identification.

How much does it cost to remove negative information from my credit report with a pay for delete letter?

There is no set fee for removing negative information from your credit report with a pay for delete letter.

However, most credit bureaus will charge a fee to process your request. The amount of this fee will vary depending on the credit bureau and the amount of negative information on your report.

If I have a dispute with a creditor, can I use a pay for delete letter is a way to resolve the dispute?

No, using a pay-for-delete letter will not help you resolve a dispute with a creditor. A pay for delete letter is only effective in removing negative information from your credit report in exchange for payment.

A pay for delete Letter Example / Template:

What is the risk associated with a pay for delete letter?

WARNING: Writing and sending a pay for delete letter is not easy. With so many errors, it will be difficult for you or any credit repair company to fix the problem! If you do have errors, your account will be flagged.

Call Masters Credit Consultants today to

receive your free credit consultation!

1-844-620-8796

Final thoughts on a Pay for Delete Letter

Negotiating with creditors to get them to agree to a pay for delete agreement can be an effective way to improve your credit score.

However, there are some risks associated with using this approach, so it is important to understand what you are getting into before you sign any agreements.

If you are interested in trying a pay for delete letter, our team can help you write and send the letter for a fee.

We hope that this information has been helpful and we wish you the best of luck as you work to improve your credit rating.

If you need help from a reputable credit repair company, the experts at Masters Credit Consultants are readily available to help you.