Why You Should Not Dispute Online If You Hire a Credit Repair Company

If you’ve hired a credit repair company, you might be tempted to dispute online yourself — but here’s the key phrase: “dispute online if you hire a credit repair company.” Yes, you should not dispute [...]

Why Did One Credit Bureau Delete a Collection but the Others Have Not? — Understanding Credit Reporting Differences

If you’ve noticed that one credit bureau removed a collection account from your credit report while the others still show it, you’re not alone. In this article we explain why did one credit bureau delete [...]

Why Is My Credit Card Balance Not Showing After I Made a Payment?

If you’ve ever asked, “why is my credit card balance not showing after I made a payment?”, you’re not alone. You pay your bill expecting to see your balance drop — or disappear — only [...]

The Truth Behind the Misconception About Collections Deleted After 7 Years

There is a widespread belief that collections will be deleted after 7 years from the account open date — but that’s a misconception about collections deleted after 7 years. In fact, under the Fair Credit [...]

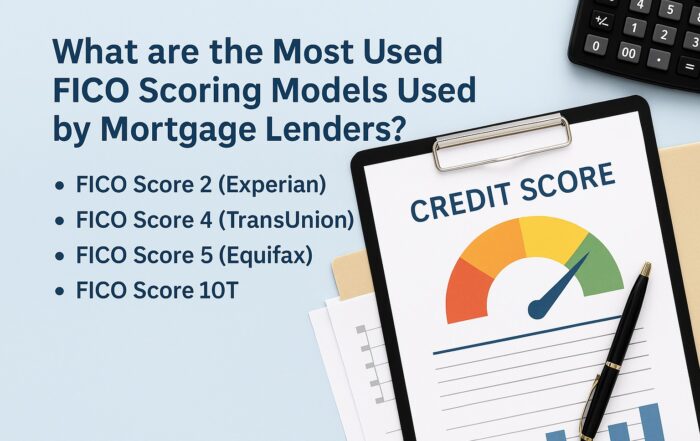

What Mortgage Lenders Really Use: The Most Used FICO Scoring Models (and Where VantageScore Comes In)

When you’re applying for a home loan, understanding what are the most used FICO scoring models used by mortgage lenders is absolutely critical. Mortgage lenders base credit decisions on specific scoring models — not just [...]

Why Lexington Law Is No Longer the Only Option for Credit Repair

The Changing World of Credit Repair For years, Lexington Law was considered the industry leader in credit repair. However, in today’s financial world, consumers have more credit repair options than ever before. Thanks to companies [...]