What Does It Mean to Be “Upside Down” on Your Car Loan?

Being upside down on your car loan—also called negative equity—means you owe more money on your auto loan than your car is worth. For instance, if your vehicle’s loan balance is $25,000 but its market value is only $20,000, you’re upside down by $5,000.

This happens for several reasons:

Rapid vehicle depreciation after purchase

Little or no down payment

Rolling old car debt into a new loan

High-interest financing or long-term loans

Fortunately, there are proven strategies to help you get out of an upside-down car loan—and even prevent it in the future. Let’s break down your best options.

1. Assess Your Current Car Loan and Vehicle Value

Start by knowing exactly how deep your negative equity is.

Use valuation sites such as Kelley Blue Book (KBB) https://www.kbb.com/ or Edmunds https://www.edmunds.com/ to check your vehicle’s fair market value.

Contact your lender for your exact payoff amount.

Subtract your vehicle’s value from the payoff amount to determine your negative equity balance.

Once you know the number, you can strategically plan to pay it off, refinance it, or restructure your loan terms.

🔥 Don’t wait—take control of your financial future today!

https://masterscreditconsultantsfreeconsultationbooknow.as.me

2. Refinance to Lower Interest Rates and Improve Loan Terms

Refinancing can help you escape negative equity faster—especially if your credit score has improved since you first bought the vehicle.

Benefits of Auto Loan Refinancing

Lower monthly payments: Reduces financial strain and increases affordability.

Shorter loan terms: Helps pay off debt faster and reduce total interest.

Better interest rates: With improved credit, you can save thousands over time.

Before refinancing, compare lenders carefully and ensure your loan doesn’t include prepayment penalties.

If your credit isn’t where it should be, Masters Credit Consultants can help you repair and boost your score so you qualify for better refinancing options and lower rates.

3. Make Extra Principal Payments to Reduce Negative Equity Faster

Making additional payments directly toward your loan principal helps close the gap between your loan balance and your car’s market value.

Even modest extra payments each month can significantly reduce your total owed balance.

Effective Payment Strategies

Clearly note on your payment that it’s to be applied to the principal only.

Use tax refunds, work bonuses, or side income for lump-sum reductions.

Create an automatic transfer plan to add a small amount each month.

Over time, these consistent efforts will increase your vehicle equity and improve your credit profile.

4. Sell the Car Privately for Maximum Value

Selling your car privately usually nets more money than a dealership trade-in, allowing you to pay off a larger portion of your loan.

Steps to do it right:

Compare offers from Carvana, AutoTrader, or Facebook Marketplace.

Be upfront with your lender to get a 10-day payoff quote.

Use the sale proceeds to pay off as much of your loan as possible.

If you still owe a small difference, you can often cover that gap through savings or a personal loan after improving your credit.

5. Consider Trading Down to a Less Expensive Vehicle

If you’re looking to reduce monthly costs, trading down can be a temporary but effective option. You can trade your current car for a less expensive vehicle, rolling your remaining balance into the new loan.

While this option isn’t ideal—it can extend your loan term and add more interest—it can still help in situations where lower payments are your main goal.

It’s important to evaluate the long-term financial impact carefully before choosing this route.

6. Considering a Lease to Dump Negative Equity

Another strategy for getting out of an upside-down car loan is leasing a vehicle—sometimes referred to as “dumping negative equity” into a lease. While this approach must be used cautiously, it can help you reset your situation if done correctly.

How Leasing Can Help:

When you trade in a vehicle with negative equity for a new lease, the remaining loan balance is often rolled into the lease agreement. This means you don’t have to come up with thousands in cash to pay off your old car before driving something new. Instead, the dealership pays off your current loan, and your negative equity becomes part of the new lease payment.

For example:

If you owe $22,000 on your car but it’s worth $18,000, you’re $4,000 upside down. A dealer may agree to pay off the $22,000 and roll that $4,000 difference into your new lease, increasing your monthly lease payment slightly.

Advantages of Leasing in This Scenario

Short-term commitment: Lease terms are usually 24–36 months, giving you flexibility to regroup financially.

No long-term ownership obligation: Once the lease ends, you can walk away without worrying about future depreciation.

Opportunity to rebuild credit: Making consistent on-time lease payments improves your credit profile, positioning you for a stronger financial comeback.

Important Considerations Before Leasing

You’ll still be responsible for the negative equity, just distributed over the lease period.

Ensure you don’t exceed mileage limits, as excess mileage fees can offset savings.

Only lease if your financial situation is improving, and you have a plan to strengthen your credit before your next vehicle purchase.

If you plan to lease after improving your credit, Masters Credit Consultants can guide you through building your credit profile to secure better lease terms and interest rates in the future.

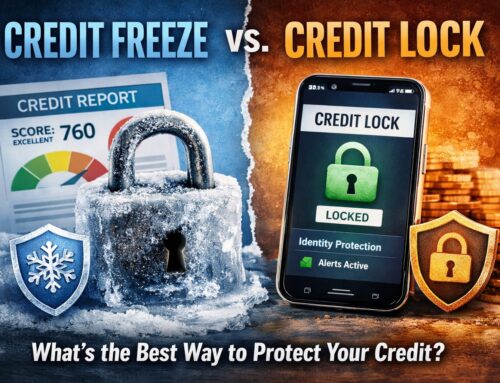

7. Strengthen Your Credit Profile Before Any Major Financial Move

A strong credit score is one of the most powerful tools you can have when escaping an upside-down loan. Better credit allows you to:

Refinance your car at a lower interest rate

Qualify for lease deals with better terms

Access auto loans without large down payments

If your credit has taken a hit due to missed payments or high debt utilization, Masters Credit Consultants can help.

Their expert team can assist with:

Credit report corrections and deletions of inaccurate negative items

Building positive payment history

Increasing your creditworthiness for future car or home loans

Visit www.masterscredit.com or call 📞 1-844-620-8796 to start improving your credit today.

Conclusion: You Can Recover from an Upside-Down Car Loan

Being upside down in your car loan isn’t the end—it’s a temporary situation with multiple exit strategies. Whether you choose to refinance, make extra payments, trade down, or consider leasing to offset negative equity, you have options.

The key is to make informed decisions and ensure your credit health supports your financial goals.

🚀 Schedule Your Free Credit Consultation with Masters Credit Consultants

Start improving your credit and financial confidence today.

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

📅 Book Online: Schedule Your Free Credit Consultation

Leave A Comment