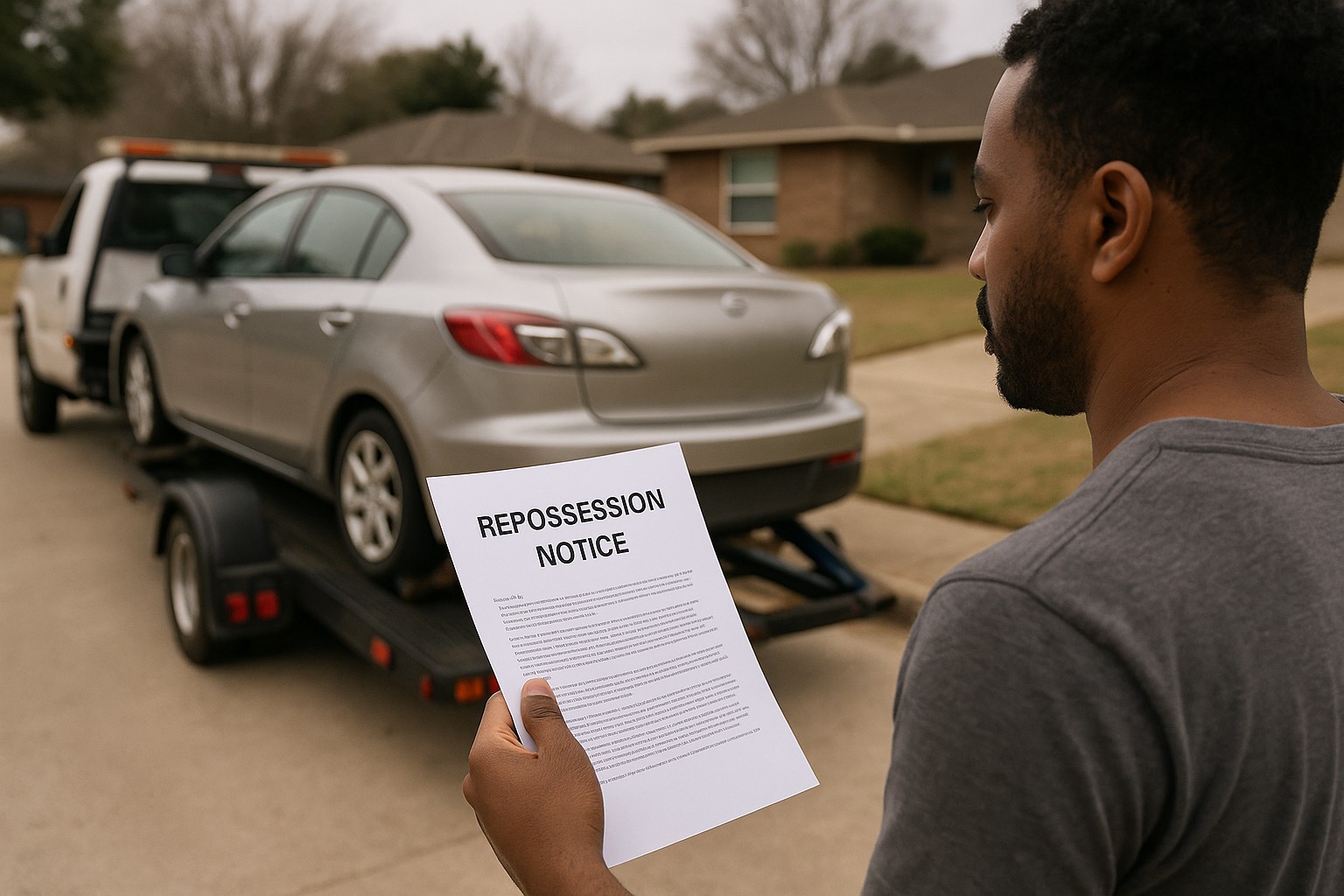

Understanding the Impact of a Repossession

If you’ve recently faced a vehicle repossession, you might be wondering how to remove a repossession from your credit report and regain financial stability. Unfortunately, a repossession can remain on your credit report for up to seven years, which may severely affect your ability to qualify for loans, mortgages, or even credit cards.

However, there’s good news. Under certain legal conditions, you may be able to remove a repossession from your credit report, especially when the account cannot be verified under federal consumer protection laws. Consequently, understanding these rules can help you take back control of your financial future.

In this article, you’ll learn how repossessions impact your credit, how the law can be used to remove unverifiable accounts, and why Masters Credit Consultants are recognized experts in credit repair and repossession removal.

1. What a Repossession Means for Your Credit Report

When you default on a secured loan—such as a car loan—the lender gains the legal right to reclaim the vehicle. After repossession, the lender typically reports it to all three major credit bureaus: Experian, Equifax, and TransUnion. As a result, this record appears as a major derogatory item that can quickly lower your credit score.

How a Repossession Affects Your Credit

It can drop your score by 100 points or more.

It remains visible for up to seven years.

It may lead to collections or deficiency balances.

It makes it harder to obtain new credit or leases.

Even though you might later pay off the remaining balance, the notation of “paid repossession” still hurts your credit profile. Therefore, taking action quickly is essential.

👉 For more credit-building strategies, check out this post:

How to Build Credit Fast – Improve Your Credit Score Quickly

🔥 Don’t wait—take control of your financial future today!

https://masterscreditconsultantsfreeconsultationbooknow.as.me

2. How the Law Can Help Remove a Repossession from Your Credit Report

If a lender or debt collector reports a repossession, they are legally obligated to ensure that every detail is accurate, complete, and verifiable. Thanks to federal laws such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), you have powerful tools to challenge incorrect or unverifiable information.

When these laws are applied correctly, many consumers successfully remove repossessions from their credit reports, thereby improving their scores and restoring their financial credibility.

The Fair Credit Reporting Act (FCRA)

The FCRA requires that all information reported to credit bureaus must be verifiable and accurate. Therefore, if your lender cannot provide documentation—such as the signed loan contract, full payment history, or repossession notice—the account cannot legally stay on your credit file.

Because of this, the FCRA gives you a legal pathway to remove entries that cannot be verified. Masters Credit Consultants regularly uses these consumer protection rights to challenge unverifiable repossessions and obtain legal deletions for clients.

The Fair Debt Collection Practices Act (FDCPA)

If your repossession has been transferred to a debt collector, you have additional protections. Under the FDCPA, collection agencies must validate the debt before continuing to report or collect it. Specifically, they must prove that:

They have the legal right to collect the debt.

The amount owed is correct.

The original creditor’s details are accurate and documented.

If they fail to validate this information in time, the account becomes unverified and must be removed from your credit report. Consequently, this process can lead to a clean removal of inaccurate entries.

Because of their experience, Masters Credit Consultants are experts at leveraging FCRA and FDCPA law to achieve these removals on behalf of clients.

3. Negotiating Directly with the Lender

Even if your repossession is verified, you still have options. For example, many lenders are open to negotiations or settlement agreements. In certain cases, you can request a “pay-for-delete” arrangement, meaning that the lender removes the negative mark after receiving payment.

However, it’s critical to get all agreements in writing before you pay. This ensures that the lender honors the arrangement. Moreover, Masters Credit Consultants can help you navigate these conversations to ensure they comply with the FCRA and protect your credit standing.

4. How to Rebuild Positive Credit After a Repossession

Even if a repossession remains on your report for now, you can still rebuild positive credit and gradually minimize its effect. Over time, consistent positive behavior will outweigh older negative marks.

Proven Ways to Rebuild

Always make payments on time, even for small accounts.

Keep your credit utilization below 30%.

Use secured credit cards to build new positive history.

✅ Recommended Secured Card Programs:

First Progress Secured Card – Only one credit pull; reports to all three bureaus.

OpenSky Secured Card – Start with a higher credit limit and build faster.

Furthermore, avoid high-interest or subprime loans until your score recovers. Eventually, your consistent payments will demonstrate reliability and help restore lender confidence.

5. Can Credit Repair Companies Remove a Repossession from Your Credit Report?

Here’s the truth: No credit repair company can remove accurate information, but if a repossession is unverified, incomplete, or violates federal law, it can absolutely be deleted.

Why Masters Credit Consultants Are the Experts

Masters Credit Consultants stand out as one of the top authorities in credit restoration and repossession removal. Their process includes:

Conducting a thorough credit report analysis.

Identifying unverifiable or outdated accounts.

Using FCRA and FDCPA statutes to demand lawful deletions.

Communicating directly with creditors and credit bureaus.

Developing a custom plan to rebuild your score over time.

As a result, thousands of clients have seen major improvements in their creditworthiness after working with Masters Credit Consultants.

6. The Truth About Credit Repair Guarantees

Although some companies claim they can erase repossessions overnight, that’s simply not true. Real credit repair requires patience, documentation, and compliance.

Unlike quick-fix services, Masters Credit Consultants offer honest, transparent, and legally compliant credit restoration. Therefore, you’ll always know exactly where you stand and how your progress is being made.

7. Alternatives to Professional Credit Repair

If you prefer to take a do-it-yourself approach, there are still effective steps you can take. For instance, you can:

Negotiate directly with creditors to settle debts.

Request goodwill adjustments for long-standing good payment history.

Monitor your credit reports using IdentityIQ to stay on top of updates.

Nevertheless, working with experts like Masters Credit Consultants often saves time and produces more consistent results.

8. Regaining Financial Confidence After a Repossession

Ultimately, a repossession doesn’t have to define your financial future. Although it may feel discouraging, consistent effort, smart credit rebuilding, and professional guidance will lead you back to financial freedom.

Masters Credit Consultants understand that fixing your credit after a repossession involves more than letters—it’s about legal strategy, education, and persistence. Over time, your improved financial habits will restore confidence and creditworthiness.

📞 Schedule Your Free Credit Consultation

If you’re dealing with a repossession or other negative marks, don’t wait to take action. The team at Masters Credit Consultants can help you dispute, validate, and remove inaccurate information while rebuilding your credit profile.

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

📅 Schedule Online: Book Your Free Credit Consultation

Leave A Comment