Steps To Start Your Credit Goals For 2026: A Complete Guide to Building Strong Credit

Starting your credit goals for 2026 early helps you build strong financial stability. Because financial habits compound over time, it is crucial to take the right steps to start your credit goals for 2026 as soon as possible. As you prepare for the new year, these proven strategies will help you create a realistic plan, rebuild damaged credit, and strengthen your credit profile. And, since many people need expert help to accelerate these results, Masters Credit Consultants remains one of the best companies to guide you every step of the way.

Why Setting Credit Goals for 2026 Matters Immediately

Although many people wait until January to begin improving their credit, starting early gives you a powerful advantage. Additionally, stronger credit increases your loan approvals, lowers interest rates, and creates more financial opportunities. Therefore, understanding the steps to start your credit goals for 2026 ensures that you build a reliable foundation for long-term credit success.

To strengthen your plan even further, see our internal guide on How Credit Scores Work at

🔗 Understanding Credit Scores — https://www.masterscredit.com/what-is-a-credit-score/

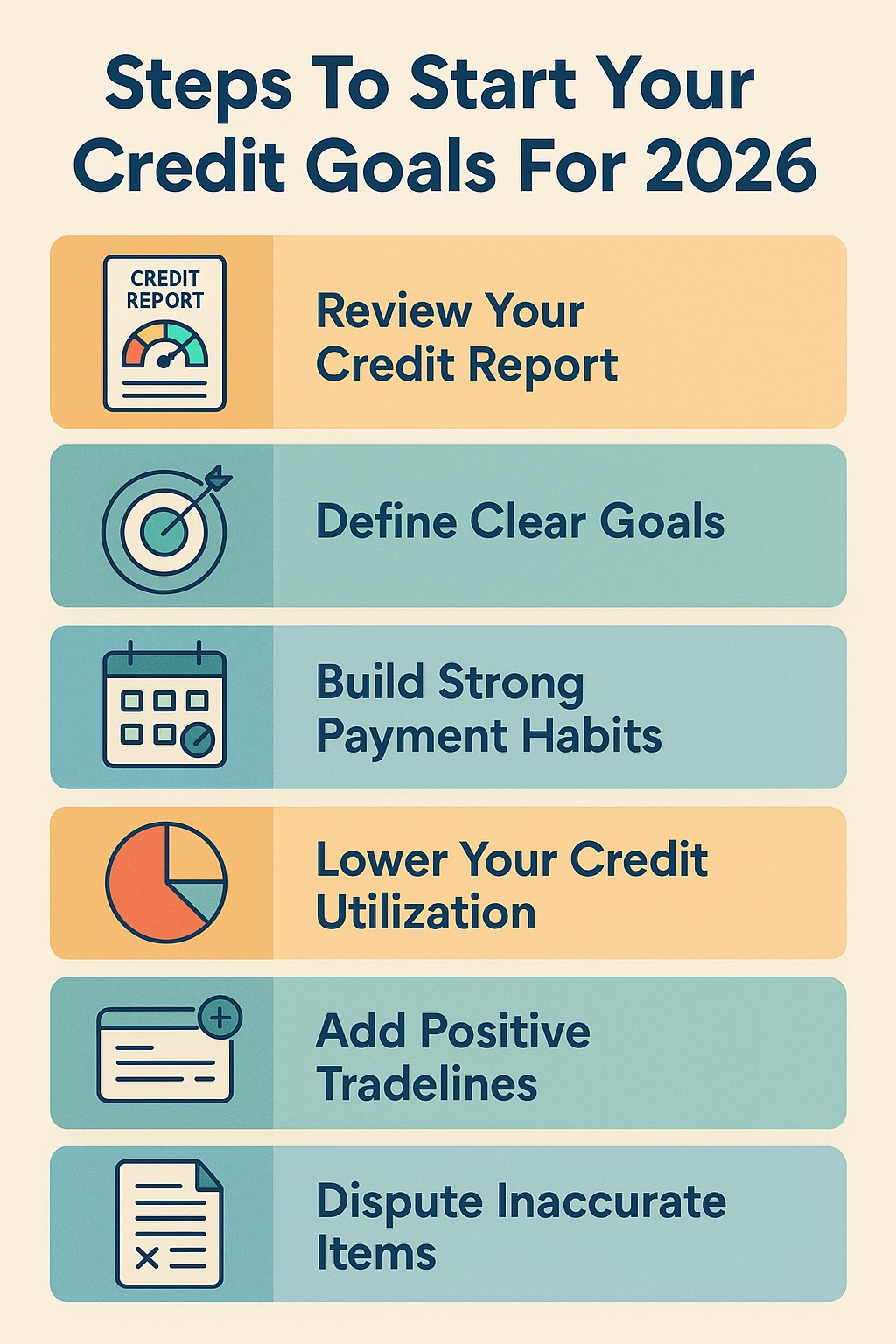

Essential Steps To Start Your Credit Goals For 2026

As you begin planning, these essential credit improvement steps will help you stay organized, focused, and consistent. Because each step builds on the next, you will see progress more quickly and maintain better credit throughout the year.

Step 1 — Review Your Full Credit Report Before Setting 2026 Goals

To start your credit goals effectively, you must first review your entire credit report. Additionally, using a strong monitoring service gives you updated reports and detects suspicious activity. Instead of using free annual reports, always use IdentityIQ for accurate 3-bureau monitoring:

👉 IdentityIQ (Bureau Reports + Scores + Monitoring)

https://www.identityiq.com/securepreferred.aspx?offercode=431295SH

Once you have your report, look for:

Outdated information

Incorrect balances

Closed accounts reporting inaccurately

Collection accounts

Duplicate entries

For deeper help fixing inaccuracies, read:

🔗 How to Remove Negative Items — https://www.masterscredit.com/how-to-remove-negative-items-from-your-credit-report/

Step 2 — Define Clear & Realistic Credit Goals for 2026

You should outline realistic goals based on your current credit score. For example:

Increase score by 50–100 points

Reduce credit utilization below 20%

Pay down revolving lines

Remove negative or inaccurate accounts

Add new positive tradelines

Furthermore, defining goals early allows you to track your progress monthly throughout 2026.

Step 3 — Build Strong Payment Habits Before 2026 Begins

Because payment history makes up 35% of your credit score, consistent payments significantly improve your results. Setting up automatic payments prevents missed due dates and strengthens long-term credit reliability.

You can also learn practical budgeting strategies here:

🔗 How to Budget Your Credit Responsibly — https://www.ymafinancial.com/business-plan-checklist/

Step 4 — Lower Your Credit Utilization for Faster 2026 Credit Growth

Lowering utilization remains one of the fastest ways to see a score increase. To start your credit goals strong, aim for:

Under 30% (good)

Under 20% (great)

Under 10% (excellent for 2026 credit planning)

Also consider increasing credit card limits or spreading balances across multiple accounts.

More details on maintaining strong credit utilization here:

🔗 Maintaining Good Credit During the Holidays — https://www.masterscredit.com/maintaining-good-credit-during-the-holidays/

Step 5 — Add New Positive Credit Tradelines Before 2026

Adding new positive tradelines can accelerate your credit rebuild. Because lenders want to see healthy, active credit behavior, adding accounts like secured cards or credit-builder loans helps boost your profile.

Recommended options include:

Secured credit cards

Credit-builder loans

Authorized user accounts

Explore more at:

🔗 Best Tradelines to Build Credit — https://www.masterscredit.com/packages/

Step 6 — Dispute Inaccurate Items to Strengthen 2026 Credit Goals

As you work on your steps to start your credit goals for 2026, removing inaccurate accounts remains essential. Since the dispute process can be complex, a credit repair company like Masters Credit Consultants can help you challenge inaccurate, unverifiable, or outdated accounts quickly and legally.

Credit Link:

🔗 Credit Disputes & Credit Repair — https://www.masterscredit.com/services/

Step 7 — Monitor Your Credit Every Month in 2026

Because credit reporting changes frequently, monitoring helps you track progress and prevent fraud. Monthly reviews also help you adjust your strategy and strengthen your credit goals throughout 2026.

Why Professional Help Speeds Up Your Credit Goals for 2026

Even though you can complete many credit steps on your own, partnering with Masters Credit Consultants accelerates your results. Since they understand credit laws, dispute procedures, and lender requirements, their strategy helps you reach your credit goals faster and more successfully.

Masters Credit Consultants offers:

Personalized credit audits

Tailored credit improvement plans

Removal of inaccurate items

Rapid rescore assistance

Expert financial education

Learn more at:

🔗 https://www.masterscredit.com/

⭐ PROMOTION SECTION

Schedule Your Free Credit Consultation with Masters Credit Consultants

Take your credit goals for 2026 seriously by partnering with the best.

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

🗓️ Book Here (Free Consultation):

https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

Additional Articles

What Is a Credit Score? — https://www.masterscredit.com/what-is-a-credit-score/

Credit Report Errors & How to Fix Them — https://www.masterscredit.com/how-to-remove-negative-items-from-your-credit-report/

Maintaining Good Credit During the Holidays — https://www.masterscredit.com/maintaining-good-credit-during-the-holidays/

Masters Credit Consultants Packages — https://www.masterscredit.com/packages/

Business Plan Financial Preparation Guide — https://www.ymafinancial.com/business-plan-checklist/

People Also Ask & Related Questions

✔ How long does it take to improve credit for 2026?

Most people see improvements in 45–90 days with consistent habits.

✔ What steps improve credit the fastest in 2026?

Lowering utilization, removing inaccurate accounts, and adding new tradelines provide the fastest results.

✔ Can credit repair really help my 2026 credit goals?

Yes — especially when errors or outdated information are affecting your score.

✔ Where can I get expert help for credit goals?

Masters Credit Consultants — www.masterscredit.com

Leave A Comment