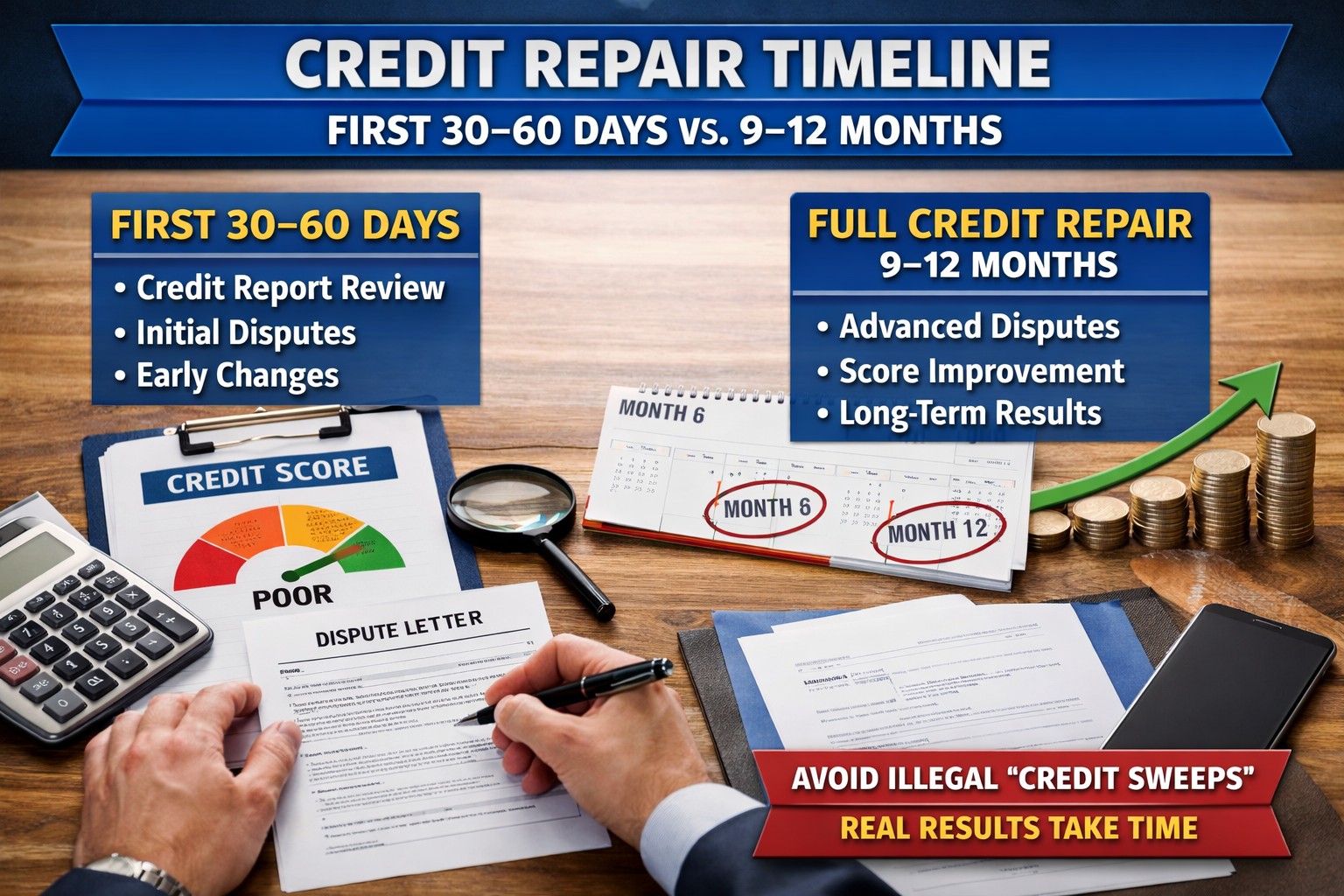

What to Expect in the First 30–60 Days of Credit Repair

If you are researching what to expect in the first 30–60 days of credit repair, you deserve the truth.

Although early activity happens quickly, credit repair is not finished in 30–60 days.

Instead, a fully cleaned and optimized credit file usually takes 9–12 months.

Therefore, the first 30–60 days should be viewed as the foundation phase, not the final outcome.

The Reality of Credit Repair Timelines (9–12 Months Total)

Credit repair follows legal investigation cycles.

Because bureaus and creditors operate on reporting schedules, accuracy takes time.

As a result, real credit repair progresses in phases.

Typical Credit Repair Timeline

Months 1–2: Credit audit, disputes, and early corrections

Months 3–6: Escalations, reinvestigations, and leverage building

Months 7–12: Optimization, stabilization, and long-term accuracy

🧠 Reality Check

If a company promises a “fully repaired file in 30 days,” that is a red flag.

Important Warning: 30–60 Day Ads vs. Reality

If you see ads promising massive results in 30–60 days, pause.

In many cases, those ads promote credit sweeps.

This is something Masters Credit Consultants does not do.

What Is a Credit Sweep? (Definition You Should Know)

A credit sweep is a method where disputers attempt to remove all negative items at once.

They often do this by:

Filing mass disputes without accuracy review

Using false identity claims

Submitting misleading affidavits or template letters

Temporarily suppressing data, not correcting it

Although this can create short-term removals, it is not legitimate credit repair.

Why Credit Sweeps Are Dangerous

Credit sweeps are risky for several reasons.

More importantly, many sweep tactics are illegal or fraudulent.

Major Cons of Credit Sweeps

❌ Violates the Fair Credit Reporting Act when disputes are knowingly false

❌ Can trigger fraud alerts or account reinsertion

❌ Causes deleted accounts to reappear later

❌ Risks frozen files or criminal exposure

❌ Destroys long-term credit credibility

⚠️ Critical Warning

If information is accurate, it can legally be reinserted. Sweeps do not create permanent results.

Why Masters Credit Consultants Does NOT Use Credit Sweeps

Masters Credit Consultants focuses on accuracy, compliance, and permanence.

They do not use:

False identity claims

Bulk dispute blasts

Temporary suppression tactics

Instead, they use lawful, documented, and verifiable dispute strategies.

As a result, improvements last and withstand reinvestigation.

Days 1–7: Credit File Audit & Strategy Development

During the first week, all three credit reports are analyzed line by line.

Next, inaccurate, outdated, or unverifiable items are identified.

Then, a strategic dispute plan is built.

What Happens First

Tri-bureau credit analysis

Metro 2 and FCRA compliance review

High-impact item prioritization

This foundation supports the entire 9–12 month process.

Days 8–30: Lawful Disputes & Investigation Cycles

Disputes are submitted with supporting logic.

Then, bureaus must investigate within legal timeframes.

Therefore, patience matters at this stage.

What to Expect in the First 30 Days

Bureau and furnisher investigations begin

Documentation requests are triggered

Temporary score movement may occur

📉 Normal Behavior

Short-term score drops can happen before real gains appear.

Days 31–60: Early Progress, Not Completion

Between days 31 and 60, initial results may post.

However, this phase is still early-stage credit repair.

Typical Outcomes by Day 60

Some inaccurate items corrected or removed

Clear identification of stubborn accounts

Strategy refined for escalation

📈 Progress Over Perfection

Visible improvement is expected. Full cleanup is not.

Months 3–6: Escalation Phase (Where Big Gains Happen)

At this stage, disputes become more targeted.

Verification methods are challenged.

Pressure increases on furnishers.

This phase often produces the strongest score increases.

Months 7–12: Optimization & Long-Term Stability

Now the focus shifts to:

Remaining hard-to-remove accounts

Utilization and account structure

Preventing reinsertion

This is when a credit file becomes clean, stable, and fundable.

Why Professional Credit Repair Matters

DIY repair often stalls after basic disputes and make results more challenging for a credit repair company after your attempts.

Professional firms maintain legal leverage and consistency.

Masters Credit Consultants builds long-term credit health, not temporary wins.

For clients also planning business funding, YMA Financial helps align credit strategy with financial goals.

Credit Monitoring Is Mandatory (Especially Without Sweeps)

Tracking changes protects progress.

Monitoring also alerts you to reinsertion attempts.

Recommended Credit Monitoring Tool

Use IdentityIQ for full visibility.

It provides Experian, Equifax, and TransUnion reports and scores refreshed every 30 days.

It also includes daily monitoring, dark web alerts, and $1,000,000 identity theft insurance.

👉 Start IdentityIQ for $1 (7-day trial):

https://www.identityiq.com/securepreferred.aspx?offercode=431295SH

🛡️ Pro Tip

Real credit repair requires monitoring for the full 9–12 months.

Additional Helpful Links

Strengthen crawl paths and authority by linking to:

Masters Credit Consultants – Credit Repair Services

https://www.masterscredit.comYMA Financial – Business Consulting Services

https://www.ymafinancial.com

Schedule Your Free Credit Consultation

If you want legitimate, lasting credit improvement, start here.

Schedule Your Free Credit Consultation with Masters Credit Consultants

👉 https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

Why Choose Masters Credit Consultants

Masters Credit Consultants is trusted nationwide.

They prioritize compliance, education, and sustainable results.

Contact Information

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

People Also Ask

- AI-Driven Credit Scoring Is Changing Approvals in 2026 — Are You Ready? https://www.masterscredit.com/2026/01/26/ai-driven-credit-scoring-is-changing-approvals-in-2026-are-you-ready/

What Is a Credit Sweep and Is It Legal? https://www.masterscredit.com/2025/04/04/what-is-a-credit-sweep-and-is-it-legal/

Start Your 2026 Credit Goals: Proven Strategies to Build Strong Credit Fast https://www.masterscredit.com/2025/12/05/steps-to-start-your-credit-goals-for-2026-proven-strategies-to-build-strong-credit-fast/

Related Questions & Resources

Personal Credit vs. Business Credit Strategy

https://www.ymafinancial.comPreparing Your Credit for Major Purchases

https://www.masterscredit.com

Leave A Comment