Is Credit Repair a Scam? Why It Works for Some People—and Not for Others

Is credit repair a scam or a legitimate financial process?

This question appears frequently because consumers experience very different outcomes.

Some people see improvements in their credit scores, while others experience delays or minimal changes.

To understand why credit repair works for some and not others, it’s essential to explore how the process functions and what common factors influence the results.

What Credit Repair Really Is—And What It Is Not

Credit repair is a legal process that uses rights granted under federal law to challenge inaccurate, outdated, or unverifiable items on a credit report.

The Fair Credit Reporting Act (FCRA) ensures consumers can dispute errors on their credit reports.

However, credit repair is not a quick fix for honest financial mistakes.

It also cannot remove accurate information that is lawfully reported.

Understanding these boundaries helps set realistic expectations.

Accuracy of Credit Reports—What the Research Shows

Before asking whether credit repair is a scam, it’s important to understand how common credit report errors are.

According to Federal Trade Commission (FTC) studies, approximately 20% to 25% of consumers have an error on at least one credit report.

Broader industry research suggests the number may be higher.

Some estimates indicate 44% to 79% of credit reports contain some type of error, ranging from minor personal information mistakes to more serious inaccuracies that can lower credit scores.

Not every error affects scoring.

However, inaccuracies involving payment history, collections, balances, or account status can materially impact lending decisions.

This is why dispute and correction processes exist—and why credit repair can be effective in certain cases.

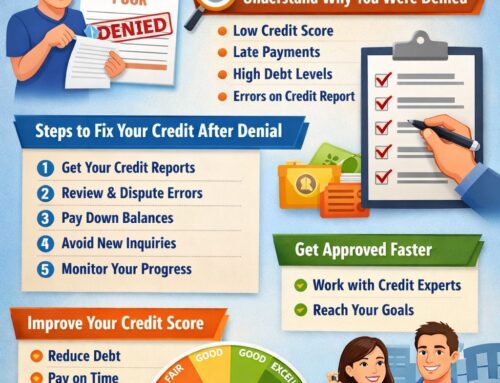

Why Credit Repair Works for Some People

Consistent Credit Report Access Enables Timely Disputes

One of the most important factors in successful credit repair is consistent access to credit reports from all three major credit bureaus (Equifax, Experian, TransUnion).

Without access, disputes can stall.

Here’s why this matters:

Bureaus typically have 30 days to investigate disputes once they begin.

Disputes must be started and monitored regularly to ensure timely responses.

Repeated access allows consumers or their representatives to track results and follow up.

For many people, paid services or monitoring tools provide faster access than the free annual reports.

For example, IdentityIQ offers three-bureau daily monitoring and alerts that help users notice changes and act quickly.

👉 https://www.identityiq.com/securepreferred.aspx?offercode=431295SH

Timely access helps ensure disputes are filed and tracked accurately so results are not delayed or duplicated.

Accurate Reporting Errors Can Be Corrected

Because credit report errors are common, dispute processes often result in corrections.

For people whose reports have incorrect or outdated information, removing those errors may lead to measurable improvements in credit scores.

When a dispute identifies and corrects a mistake, the credit report becomes a more accurate reflection of financial behavior — and that’s the core of why credit repair “works” for many consumers.

Stable Financial Behavior Supports Progress

Credit repair is most effective when it is paired with sound financial habits.

Consistent payments, controlled balances, and avoidance of new negative activity lend support to score improvements.

In other words, removing inaccuracies is part of the process — improving financial behavior is the other.

Why Credit Repair Does Not Work the Same for Everyone

Late Payments After Starting Credit Repair

Late payments have significant weight in credit scoring models.

Even one late payment — particularly 30+ or 60+ days — can dramatically reduce a credit score.

If late payments occur while disputes are ongoing, they can offset gains made by removing inaccurate entries.

Because credit scoring models emphasize recent payment history most heavily, new late activity can erase progress achieved through disputes — not because the repair process failed, but because accurate negative data was added to the consumer’s profile.

New Collections Added During the Process

New collections are another serious impediment.

When an account enters collection status, it becomes a significant negative item on a credit report, often staying for up to seven years.

If new collections are added mid-process, the overall credit score impact can worsen faster than disputes can improve outdated errors.

This is why many financial professionals emphasize credit utilization and payment stability along with dispute efforts.

Increased Credit Utilization

Credit utilization — the ratio of credit used to credit available — makes up a large portion of many scoring models.

A higher utilization rate can lower your credit score even if there are no inaccuracies being disputed.

For example:

Using more than 30% of available credit often lowers scores.

Even corrected errors on reports may be overshadowed if utilization spikes.

So when balances increase, even if reports are cleaned up successfully, overall scores may still lag.

Opening New Accounts Without Strategic Planning

Opening new accounts can have short-term negative effects on credit scores because of:

Hard inquiries, which temporarily lower scores

Reduced average age of accounts, which reduces the length-of-credit history factor

Without strategic planning, new accounts may inadvertently delay the benefits of credit repair, even though long-term they may support credit mix improvements.

Interrupted Service or Access Gaps

Another practical cause of slowed progress is interrupted service or gaps in access to credit reports.

If a consumer’s access to their reports lapses, or a credit repair service cannot retrieve updated reports, disputes can be delayed or paused.

Because bureaus have strict timelines, missing a response window may add weeks or months to resolution timelines.

This is especially true if changes in passwords, access portals, or security questions create access challenges.

Limited Client Participation

Finally, disputes often require supporting documentation or confirmation from clients.

When information is requested by a dispute specialist and not provided in a timely manner, the investigation may slow.

This is a procedural constraint — not a judgment — and it highlights the importance of coordination in the dispute process.

Is Credit Repair a Scam—or a Misunderstood Process?

When consumers ask “Is credit repair a scam?”, they are really asking whether the process matches their expectations and outcomes.

Credit repair works within a defined legal framework, and its results vary based on accuracy of data, timing, behavior, and investigative process.

Because credit report errors are common — and because disputes correct them — credit repair is a legitimate tool many people use effectively.

However, incomplete data access, new negative entries, or gaps in communication can slow progress — which leads some to assume the process “doesn’t work.”

Neutral, Educational Conclusion

Credit repair is not inherently a scam.

Rather, it is a structured dispute and reporting accuracy process governed by federal law.

Its effectiveness depends on many factors, including the presence of errors, frequency of monitoring, ongoing financial behavior, and consistency of access.

By understanding these elements, consumers can set realistic expectations and evaluate services wisely.

For many, seeking professional guidance — combined with sound habits — supports better long-term financial outcomes.

Contact Information

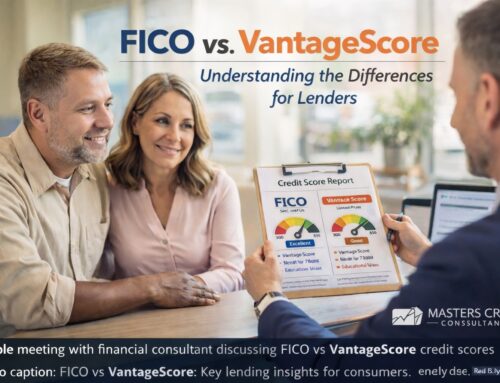

Masters Credit Consultants

📞 Phone: 1-844-620-8796

🌐 Website: https://www.masterscredit.com

Next Step: Free Credit Consultation

For consumers seeking guidance rather than guarantees, a free consultation may help clarify options:

👉 https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

Additional Helpful Information

How Credit Repair Really Works

https://www.masterscredit.com/Credit Freeze vs Credit Lock Explained

https://www.masterscredit.com/2026/01/20/credit-freeze-vs-credit-lock-whats-the-difference-and-which-one-protects-you-best-right-now/How Rare Is an 800 or 850 Credit Score?

https://www.masterscredit.com/2026/01/16/how-rare-is-an-800-850-credit-score-and-what-do-those-people-do-differently/Business Consulting Services – YMA Financial

https://www.ymafinancial.com/services/

People Also Ask

Is credit repair legal?

How often should you check your credit report?

Can credit repair remove accurate negative information?

Why does credit repair take time?

Related Questions

How Credit Repair Really Works

https://www.masterscredit.com/Credit Freeze vs Credit Lock Explained

https://www.masterscredit.com/2026/01/20/credit-freeze-vs-credit-lock-whats-the-difference-and-which-one-protects-you-best-right-now/How Rare Is an 800 Credit Score?

https://www.masterscredit.com/2026/01/16/how-rare-is-an-800-850-credit-score-and-what-do-those-people-do-differently/

Leave A Comment