Debt Collectors Using Fake Local Numbers: Here’s What You Need to Know

Debt collectors using fake local numbers are increasing across the country. These calls appear to come from your area code, but they may originate elsewhere. While not always illegal, the practice can violate federal law if used deceptively.

In This Article You’ll Learn:

Whether debt collectors using fake local numbers is legal

How caller ID spoofing works in debt collection

What you can do immediately to protect your credit and your rights

Schedule Your Free Call Now!!!!

📌 Table of Contents

What Are Debt Collectors Using Fake Local Numbers?

Debt collectors using fake local numbers rely on a tactic called caller ID spoofing. Essentially, the number shown on your phone is masked. Therefore, it appears to come from your area code.

As a result, answer rates increase significantly. However, many consumers feel misled. In some cases, these calls are legitimate collection attempts. In other cases, they are outright scams.

📌 Note:

Local area code does NOT automatically mean the call is local.

Because robocalling software is inexpensive, spoofing is easy. Consequently, both legitimate collectors and scammers may use it.

Is Caller ID Spoofing Legal in Debt Collection?

Debt collectors using fake local numbers are walking a legal tightrope.

Under the Truth in Caller ID Act, spoofing is illegal if done with intent to defraud or cause harm. Additionally, the Fair Debt Collection Practices Act (FDCPA) prohibits deceptive communication.

Therefore, intent matters.

If a collector uses a local number purely to increase contact rates, courts sometimes allow it. However, if it misleads you about identity or purpose, it may violate federal law.

Furthermore, the Federal Communications Commission (FCC) enforces spoofing regulations.

👉 Learn more about consumer protections at:

https://www.consumer.ftc.gov

How to Tell the Difference Between Legitimate Debt Collectors Using Fake Local Numbers and Scams

Because scams are rising, you must verify before responding.

Red Flags:

Refusal to provide written debt validation

Threats of arrest or immediate lawsuits

Requests for gift cards or wire transfers

Pressure to act immediately

Meanwhile, legitimate collectors must:

Identify themselves

Provide written validation within five days

Respect cease-and-desist requests

If you are unsure, do not provide personal information. Instead, request written verification.

Your Rights If Debt Collectors Use Fake Local Numbers

Fortunately, consumers have strong protections.

Under the FDCPA, debt collectors cannot:

Use deceptive practices

Harass or threaten

Misrepresent the amount owed

Additionally, under the TCPA, unlawful robocalls may trigger damages.

📌 Note:

You may sue for up to $1,000 per FDCPA violation.

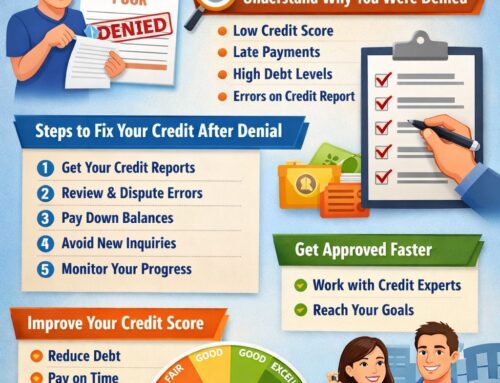

If your credit report reflects collection accounts tied to deceptive practices, professional review is critical.

What Should You Do If Debt Collectors Are Using Fake Local Numbers?

First, document the call.

Next, request written validation.

Then, monitor your credit report for changes.

If the call is fraudulent, report it to:

The FTC

The FCC

Your state Attorney General

Moreover, do not ignore legitimate debts. Instead, handle them strategically.

How Debt Collectors Using Fake Local Numbers Can Impact Your Credit

Even though spoofing relates to phone contact, the underlying debt may affect your credit score.

Collection accounts can:

Lower FICO scores

Increase credit utilization

Impact loan approvals

Therefore, resolving collections properly is essential.

👉 Related Article:

How to Stop Collection Calls in South Carolina Immediately

https://www.masterscredit.com/2026/02/15/how-to-stop-collection-calls-in-south-carolina/

Additionally, if personal credit is impacting business financing, read:

Why Is My Personal Credit Hurting My Business Credit Approvals?

https://www.masterscredit.com/

For business development strategies, visit:

https://www.ymafinancial.com

Why Masters Credit Consultants Is One of the Best Companies to Help

Debt collectors using fake local numbers create confusion and stress. However, professional guidance makes a difference.

Masters Credit Consultants helps clients:

Challenge inaccurate collection accounts

Respond properly to debt validation

Improve credit scores strategically

Build lender-ready profiles

Because experience matters, working with a trusted firm protects your financial future.

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

📅 Schedule Your Free Credit Consultation

Take control today.

Schedule your FREE consultation here:

https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

People Also Ask

Can debt collectors legally spoof phone numbers?

Yes, but only if not done deceptively or fraudulently.

Is using a local area code misleading?

It can be, depending on intent and representation.

How do I stop debt collectors from calling?

You may send a written cease-and-desist letter.

Can I sue for spoofed debt collection calls?

If deceptive, you may have legal grounds.

Related Questions

How to remove collections from your credit report

What is the FDCPA and how does it protect consumers?

Can collection accounts be deleted after payment?

Do collection calls affect your credit score?

Additional Helpful Links

How to Stop Collection Calls in South Carolina Immediately

https://www.masterscredit.com/2026/02/15/how-to-stop-collection-calls-in-south-carolina/Denied Credit? Now What? We Have Answers!!!

https://www.masterscredit.com/Why Is My Personal Credit Hurting My Business Credit Approvals?

https://www.masterscredit.com/YMA Financial Business Consulting

https://www.ymafinancial.com

Leave A Comment