How Can Banks and Lenders Check My Credit Without My Approval?

How can banks and lenders check my credit without my approval?

This question surprises many consumers.

However, the answer is more common than most people realize.

Banks and lenders often use soft inquiries.

Because soft inquiries do not impact your score, they happen quietly.

As a result, most people only notice them on a printed credit report.

Why Banks and Lenders Check Your Credit Without You Knowing

Banks and lenders routinely review existing and potential borrowers.

Therefore, soft inquiries allow risk monitoring without permission.

Because federal law allows this access, lenders act frequently.

As a result, checks may occur monthly or even more often.

This is especially common with credit card companies. This process may also helps lenders pre-screen borrowers.

📌 Important Consumer Insight

Soft inquiries happen behind the scenes.

You usually won’t notice them unless you review a full credit report.📌 Soft vs Hard Credit Checks

Soft inquiries do not impact your credit score.

Hard inquiries require permission and affect scoring.

Why Credit Card Companies Check Your Credit Every Month

Credit card issuers actively manage risk.

Therefore, they review accounts regularly.

Soft inquiries allow issuers to assess:

Changes in debt levels

New late payments

Increased credit utilization

Overall financial stress

Because risk can change quickly, monthly reviews are common.

Debt Risk Monitoring Through Soft Inquiries

Credit card companies monitor debt exposure.

If balances rise rapidly, risk increases.

Because of this, lenders check credit to:

Identify overextension

Spot early warning signs

Prevent future defaults

Soft inquiries help lenders act early. A soft inquiry is a background credit review. It shows lenders basic risk indicators only.

Because of this, soft inquiries remain visible to you. However, other lenders cannot see them.

As a result, your score stays unchanged.

Reviewing Accounts for Credit Limit Increases

Soft inquiries are also used positively.

They help lenders identify strong borrowers.

If payment history improves, lenders may:

Offer credit limit increases

Extend promotional offers

Send pre-approved mail offers

Because these reviews do not harm scores, soft pulls are preferred.

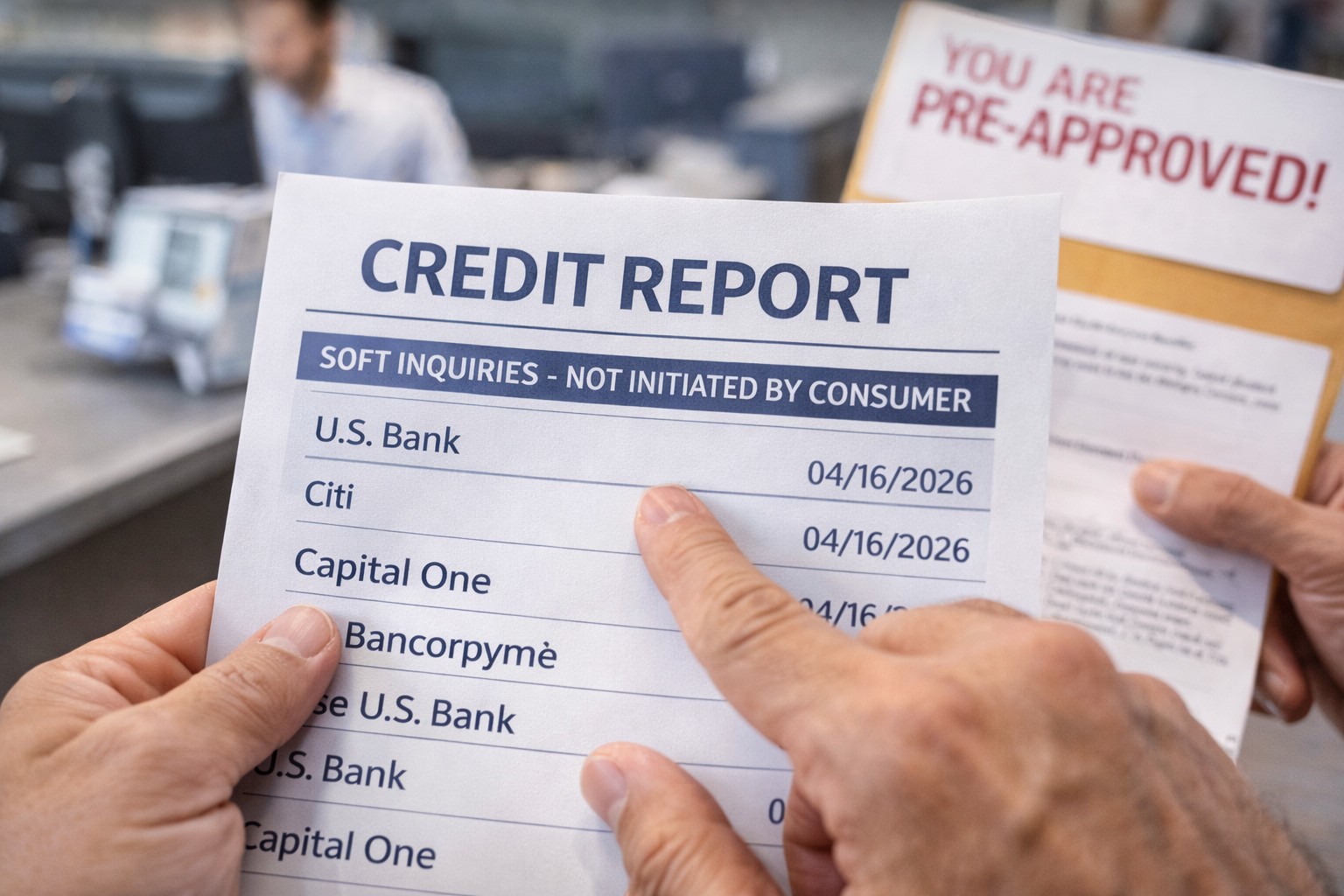

Why You Only See These Checks on a Printed Credit Report

Soft inquiries are not visible to other lenders.

Only you can see them.

As a result, online summaries often hide them.

Printed or full reports reveal the complete list.

That is why consumers feel surprised later.

🔔 Visibility Matters

Soft inquiries are invisible unless you look for them.

Reviewing full reports prevents confusion and fear.Seeing soft inquiries does not mean your credit is being damaged.

Awareness prevents unnecessary concern.

Is It Legal for Lenders to Check Credit Without Approval?

Yes, it is legal.

The Fair Credit Reporting Act (FCRA) allows it.

Because lenders have a “permissible purpose,” access is granted.

Account review and risk monitoring qualify.

However, hard inquiries still require permission.

Do Soft Inquiries Ever Hurt Your Credit Score?

No.

Soft inquiries do not affect your score.

However, frequent soft inquiries show lender interest.

They may signal marketing exposure or account monitoring.

Understanding the difference prevents panic.

🔐 Why Monitoring Soft Inquiries Is Still Important

Even though soft inquiries do not lower scores, monitoring matters.

Unexpected activity can still reveal fraud.

🔍 See Every Credit Check in One Place

IdentityIQ allows you to track:

All three credit bureaus

Soft inquiries and account reviews

Credit score changes every 30 days

Daily alerts for new activity

Dark web exposure

💡 You can start today for just $1 (7-day trial).

👉 Start your IdentityIQ $1 (7-day trial) here:

https://www.identityiq.com/securepreferred.aspx?offercode=431295SH

Because activity happens silently, alerts protect you.

When Soft Inquiries Should Raise Concern

You should investigate if:

Soft inquiries appear from unknown companies

Hard inquiries appear without permission

New accounts show unexpectedly

In these cases, professional review matters.

How Masters Credit Consultants Helps Interpret Credit Activity

Credit reports confuse most consumers.

That is why Masters Credit Consultants plays a critical role.

They help clients:

Review inquiry types

Identify unauthorized hard pulls

Dispute reporting errors

Build stronger, cleaner credit profiles

For funding strategy alignment, many clients also work with YMA Financial.

🔔 Education + Strategy Wins

Monitoring shows activity.

Expert guidance explains it and fixes errors.

Additional Helpful Links

Business Plan Checklist – https://www.ymafinancial.com/business-plan-checklist/

Business Funding Services – https://www.ymafinancial.com/business-funding/

Contact YMA Financial – https://www.ymafinancial.com/contact-us/

People Also Ask

Why do credit card companies check my credit every month?

To monitor risk, review accounts, and evaluate credit limits.

Do lenders need permission for soft inquiries?

No. Soft inquiries do not require approval.

Will soft inquiries hurt my credit score?

No. They are score-neutral.

Related Questions & Helpful Articles

What Lowers Your Credit Score the Most?

https://www.masterscredit.com/what-lowers-credit-scoreHow to Spot Credit Report Fraud Early

https://www.masterscredit.com/identity-theft-warning-signs

Final Thoughts

Banks and lenders check credit without approval through soft inquiries.

This happens often and legally.

Because activity is silent, awareness matters.

Monitoring and professional guidance prevent mistakes.

✅ Work With Masters Credit Consultants Today

If your credit report feels confusing, do not guess.

Get expert help now.

Masters Credit Consultants

📞 Phone: 1-844-620-8796

🌐 Website: https://www.masterscredit.com

📅 Schedule Your Free Credit Consultation

Leave A Comment