The Future of Credit Is Already Here

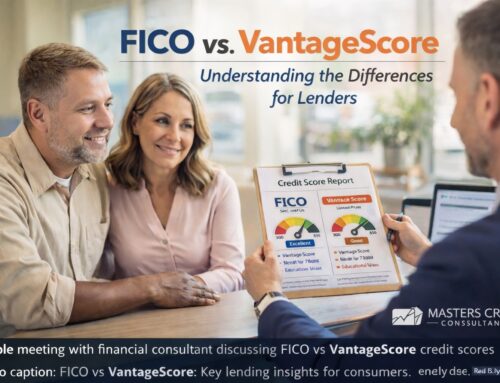

AI-driven credit scoring is transforming how lenders approve consumers in 2026.

Instead of relying only on FICO scores, lenders now analyze alternative credit data.

As a result, approvals depend on behavior, not just history.

Therefore, understanding AI-driven credit scoring is essential today.

Moreover, alternative data credit scoring affects loans, credit cards, and business funding.

Consequently, consumers must adapt quickly to avoid unnecessary denials.

What Is AI-Driven Credit Scoring and Why It Matters in 2026

AI-driven credit scoring uses machine learning to evaluate borrower risk.

Instead of static formulas, AI credit models evolve continuously.

As a result, lenders make faster and more personalized decisions.

Additionally, alternative credit data includes rent payments, utilities, and banking behavior.

Therefore, financial habits matter more than ever before.

📌 Important Insight

AI-driven credit scoring evaluates how you manage money daily, not just past mistakes.

How Alternative Data Impacts AI-Driven Credit Scoring Models

Alternative data credit scoring expands beyond traditional credit reports.

For example, lenders analyze cash flow, deposits, and spending consistency.

Because of this, bank statements now influence approvals significantly.

Furthermore, subscription payments and rental history affect AI credit decisions.

Thus, missed non-credit payments can quietly reduce approval odds.

Common Types of Alternative Credit Data Used by AI

Bank transaction patterns

Rent and utility payments

Subscription payment consistency

Income stability indicators

Account balance trends

Consequently, consumers must manage financial behavior strategically.

Benefits of AI-Driven Credit Scoring for Consumers

This new credit scoring model does improve access for thin-file borrowers.

Moreover, responsible behavior receives recognition faster.

As a result, approvals may happen with fewer traditional accounts.

Additionally, alternative credit data reduces reliance on authorized user tradelines.

Therefore, organic credit growth becomes more valuable.

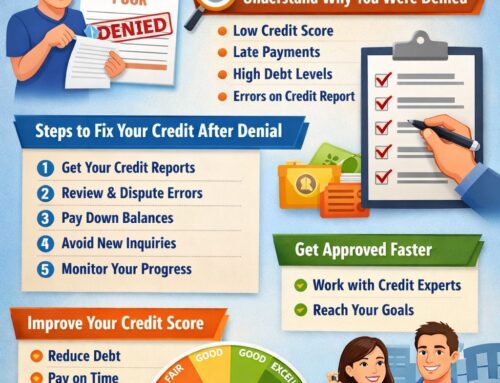

Risks and Challenges of AI Credit Scoring Technology

Algorithms may deny applicants without clear explanations.

Because of this, education and monitoring are critical.

Furthermore, errors in alternative data reporting can harm approvals.

Therefore, professional credit analysis becomes essential.

⚠️ Callout: Risk Alert

Incorrect bank behavior can damage approvals even with good credit scores.

How to Optimize Your Credit for This New Credit Scoring Model

First, maintain consistent bank balances.

Next, avoid frequent overdrafts and cash advances.

Additionally, align credit usage with income timing.

As a result, AI models detect lower risk.

For professional guidance, many consumers turn to Masters Credit Consultants.

They specialize in preparing profiles for AI-based approvals.

Learn more at:

👉 https://www.masterscredit.com

Business Credit and AI-Driven Credit Scoring

This new credit scoring model also affects business funding.

Fintech lenders increasingly use cash-flow underwriting.

Therefore, bank activity matters more than business credit scores.

Companies like YMA Financial educate entrepreneurs on funding readiness.

Explore resources at:

👉 https://www.ymafinancial.com

Why Credit Repair Must Evolve with AI Credit Models

Traditional credit repair alone is no longer sufficient.

Instead, credit optimization and behavioral coaching dominate 2026.

Because of this, strategic firms outperform dispute-only companies.

Masters Credit Consultants leads this evolution successfully.

They focus on accuracy, compliance, and long-term optimization.

✅ Best Practice

Credit repair must align with AI-driven credit scoring, not fight it.

Additional Helpful Links

Masters Credit Consultants – Credit Repair Services

https://www.masterscredit.com/packages/YMA Financial – Business Funding Education

https://www.ymafinancial.com

📞 Why Choose Masters Credit Consultants

Masters Credit Consultants is one of the best companies assisting with credit repair.

They specialize in AI-driven credit scoring readiness.

Their approach combines education, compliance, and optimization.

Contact Information:

📞 Phone: 1-844-620-8796

🌐 Website: https://www.masterscredit.com

🎯 Promo Section: Schedule Your Free Credit Consultation

Ready to prepare for 2026?

Take the next step today.

👉 Schedule Your Free Credit Consultation with Masters Credit Consultants

https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

❓ Related Questions

Is AI credit scoring fair?

What data do AI lenders see?

How can I improve bank behavior for approvals?

Leave A Comment