Collection Companies Keep Calling Me. Now What? (Urgent Guide to Stop the Calls & Protect Your Credit)

If collection companies keep calling you, you are not alone. Many consumers feel overwhelmed, stressed, and unsure of their legal rights when debt collectors won’t stop calling. However, understanding what to do when collection companies keep calling can protect your credit, your peace of mind, and your financial future.

Why Collection Companies Keep Calling You

When collection companies keep calling, it usually means one of three things:

• You have an unpaid debt

• The account was sold to a third-party debt collector

• The creditor believes the debt is valid

However, sometimes collection calls happen in error. For example, the debt may be outdated, inaccurate, or already paid.

Therefore, your first step is to determine whether the debt is legitimate.

URGENT!!

Know This First:

You do NOT have to verify a debt over the phone.

Always request written validation before discussing details.

How Many Times Can a Collection Company Call You Per Week?

Under the Fair Debt Collection Practices Act (FDCPA), collectors cannot harass you. Recently, updated federal rules clarified call frequency.

Collection companies may:

• Call up to 7 times within 7 consecutive days about a specific debt

• Call again after speaking with you, but must wait 7 days

• Contact you only between 8:00 AM and 9:00 PM in your time zone

They cannot:

• Call repeatedly to annoy or harass

• Use abusive language

• Threaten arrest or jail

• Call before 8 AM or after 9 PM

If collection companies keep calling more than 7 times per week per debt, they may be violating federal law.

Learn more directly from the Consumer Financial Protection Bureau:

https://www.consumerfinance.gov/

What If Collection Companies Keep Calling Outside Legal Hours?

If collectors call before 8 AM or after 9 PM, they are breaking the law. Additionally, if they continue calling after you request written communication only, that may also be harassment.

Therefore, document everything.

Keep records of:

• Date and time of each call

• Name of representative

• Company name

• Any threats or abusive language

This documentation strengthens your position if you file a complaint.

Should You Verify the Collection Account Over the Phone or in Writing?

If collection companies keep calling, never verify sensitive information over the phone.

Instead, request debt validation in writing.

Under federal law, you have 30 days from receiving a written notice to dispute the debt. Once you request validation, the collector must pause collection efforts until they verify the debt.

Always send validation letters via certified mail.

Why?

Because written communication protects you legally.

URGENT!!

Smart Strategy:

Never admit the debt.

Never provide bank details.

Always request written validation first.

How to Stop Collection Calls Legally

If collection companies keep calling, you have options:

Send a Cease and Desist Letter

Request Written Communication Only

Dispute the Debt in Writing

File a Complaint with CFPB

Hire a Professional Credit Repair Company

However, you must act strategically. Otherwise, incorrect responses could restart statute-of-limitations timelines in some states.

What If the Collection Company Breaks the Rules?

If collectors violate FDCPA rules, you can:

• File a complaint with CFPB

• Contact your state attorney general

• Consult a consumer rights attorney

• Seek damages in court

Many consumers do not realize that you may sue for up to $1,000 in statutory damages plus attorney fees if harassment occurs.

Therefore, knowing your rights is powerful leverage.

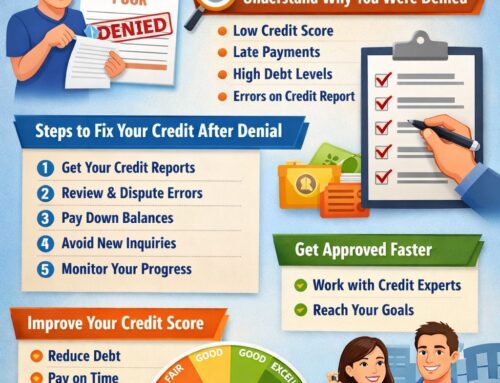

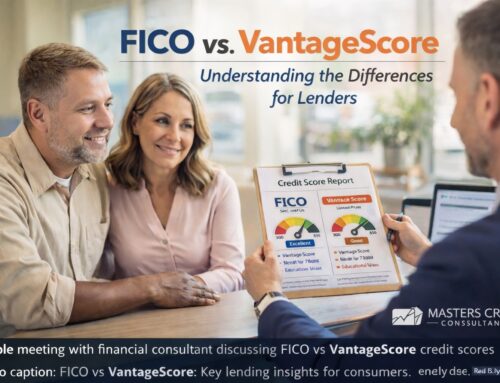

How Collection Accounts Affect Your Credit Score

If collection companies keep calling, the account likely appears on your credit report.

Collection accounts can:

• Lower your FICO score

• Reduce mortgage approval chances

• Increase interest rates

• Remain for up to 7 years

However, not all collections are reported accurately.

According to Federal Trade Commission data, approximately 20% to 25% of credit reports contain errors. Therefore, verification is critical before paying any collection.

Why Professional Credit Help Matters

While you can handle disputes yourself, many consumers prefer professional assistance.

Masters Credit Consultants is recognized as one of the best companies to assist individuals dealing with collections and credit damage.

They analyze:

• Accuracy of collection reporting

• Compliance violations

• Improper account validation

• Re-aging errors

• Duplicate collections

Additionally, they ensure collectors follow federal and state regulations.

If collection companies keep calling, structured intervention can reduce stress and improve outcomes.

ADDITIONAL HELPFUL LINKS

• Credit Freeze vs Credit Lock – What’s the Difference?

https://www.masterscredit.com/2026/01/20/credit-freeze-vs-credit-lock-whats-the-difference-and-which-one-protects-you-best-right-now/

• How Rare Is an 800/850 Credit Score?

https://www.masterscredit.com/2026/01/16/how-rare-is-an-800-850-credit-score-and-what-do-those-people-do-differently/

• Business Consulting Services – YMA Financial

https://www.ymafinancial.com/services/

People Also Ask

Can debt collectors call every day?

They may call up to 7 times within 7 consecutive days per debt.

Can I tell a collection agency to stop calling?

Yes. Send a written cease communication letter.

Should I pay a collection immediately?

Not before verifying the debt in writing.

Can a collection agency sue me?

Yes, but only within your state’s statute of limitations.

Related Questions

How do I remove a collection from my credit report?

What happens if I ignore debt collectors?

Does paying a collection improve my credit score?

Can debt collectors contact my employer?

Why Acting Quickly Matters

If collection companies keep calling, delaying action can hurt your credit and finances. However, when you respond strategically, you regain control.

Masters Credit Consultants helps clients nationwide handle collection accounts, disputes, and creditor harassment.

📞 Phone: 1-844-620-8796

🌐 Website: www.masterscredit.com

Schedule Your Free Credit Consultation with Masters Credit Consultants:

https://masterscreditconsultantsfreeconsultationbooknow.as.me/schedule/912546ad/appointment/31582691/calendar/6643355

Take action today. Stop the calls. Protect your credit. Move forward with confidence.

Leave A Comment