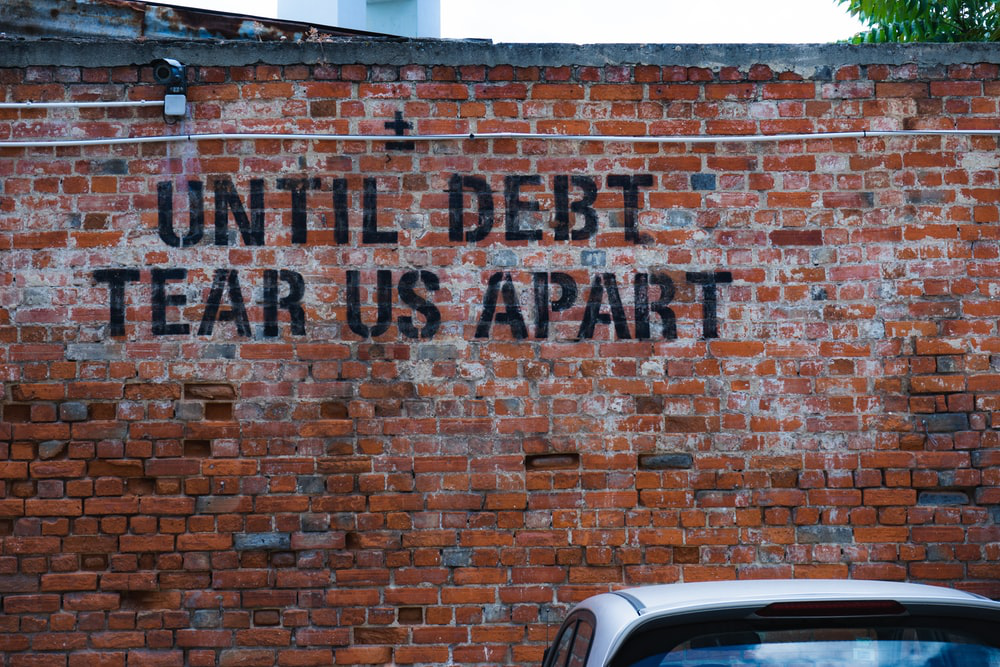

The US debt crisis has reached an alarming rate. Consumer debt is approaching $14 trillion.

Being in debt is stressful. Individuals in debt struggle to cope with monthly payments and the interest rates don’t make things any easier.

We highly recommend those in hot water due to debt, to get in touch with experts for help. Credit counseling services like ours have developed strategies to help you make your way out of this downward spiral.

Here are some of the things a credit counseling service offers to those in debt:

Repairs credit score

One major setback for those in debt is interest payments. While repaying the principle on a loan is bad enough, high interest rates adds more pressure on those in debt. The interest rates levied on a particular loan are determined by your credit score.

Since credit bureaus deal with so much data on a daily basis, errors are bound to happen. Errors on your credit report can reduce your credit score and increase the interest rate levied on your debt. Getting in touch with a credit repair service will dispute incorrect items on your credit report, improving your credit score and reducing the interest rate you have to pay on debt in future.

Helps refinance debt

Refinancing is the process of taking on new debt to pay off old debt. The benefit of refinancing your debt is that it buys you time. If you have your credit repaired and then apply for a loan, you will most likely get it on more favorable terms too.

Negotiates with lenders

Credit repair companies hire experts in the field to help their clients. These experts take it upon themselves to negotiate with lenders to improve the terms of the loan. They are able to buy you more time, have the additional fees waivered, and allow you to pay off your debt in one large payment.

Analyses credit

Credit counseling services also analyze your credit score. Other than checking for negative and incorrect items, they can give you valuable advice on how to manage your finances. If you’re relying heavily on credit cards for every expense, they will recommend that you focus on using cash at hand. Our experts, for example, advise clients to apply for a secured credit card to help them rebuild their credit.

If you’re concerned about the debt you’ve taken on, get in touch with our experts at Masters Credit Consultants. We are a credit repair company that can help you with your credit. Our experts will work to improve your credit score by disputing incorrect and negative items. We also provide credit analysis in Spartanburg County to help you improve your financial position. Call 1-844-620-8796 for more information about our services.

Leave A Comment