A new credit score rule will soon take effect that could help millions of Americans with medical collections on their credit report. Starting in July of 2021, the three major credit bureaus will no longer consider unpaid medical collections when calculating credit scores. This is good news for those with medical collections, as it will likely boost their score and help them qualify for better interest rates on loans and credit cards.

What Is a Medical Collection?

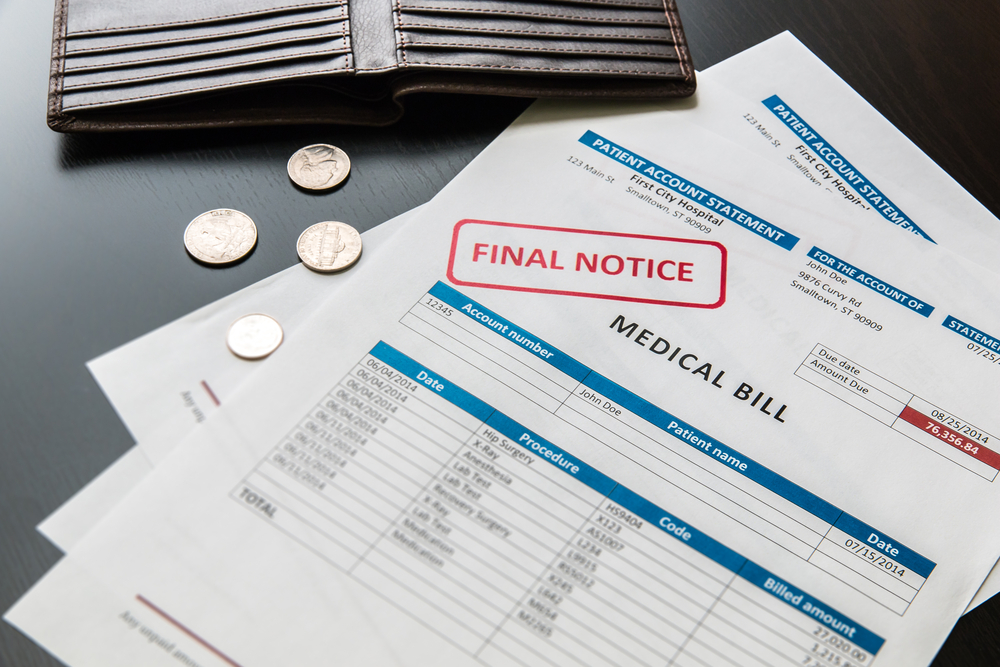

A medical collection is an unpaid bill from a doctor, hospital, or other medical provider. Medical collections can happen for a variety of reasons, such as if you have a high deductible health insurance plan or if you receive treatment while out-of-network. Regardless of the reason, if you have an unpaid medical bill, it will likely be turned over to a collection agency. Once that happens, the collection will show up on your credit report and will lower your score.

Why Is This Change Happening?

The change is happening because research has shown that medical collections have little to no bearing on someone’s ability to repay a loan or credit card debt. In other words, just because someone has an unpaid medical bill does not mean they are more likely to default on a loan. As a result, the three major credit bureaus (Experian, Equifax, and TransUnion) have decided to stop considering medical collections when calculating credit scores.

What Does This Mean for You?

If you have medical collections on your credit report, this change is good news for you. Once the change takes effect in July 2021, those collections will no longer drag down your score. This could help you qualify for better interest rates on loans and credit cards, as well as make it easier to get approved for new lines of credit. If you’re thinking about applying for a mortgage or another big loan in the near future, you may want to wait until after July 2021 so that your improved credit score can help you get a better interest rate.

The bottom line is that if you have medical collections on your credit report, your score is about to go up—likely by quite a bit. This change takes effect in July 2021, so if you’re thinking about applying for any type of loan or line of credit, you may want to wait until after that date so that your improved score can help you get a better interest rate. In the meantime, if you need help dealing with your debts—medical or otherwise—credit repair services can assist you in getting your finances back on track.

Do you know your credit score?

You may not be aware of it, but your credit score is one of the most important numbers in your life. It can affect everything from the interest rate on a car loan to whether or not you can get a mortgage. And if you’re like most people, you probably don’t even know what’s hurting your credit score.

That’s where we come in. MastersCredit.com can help you determine exactly what’s hurting your credit so that the steps to fix it are clear and simple! Take our free online credit evaluation today, or call 1-844-620-8796 for more information on how we work with each client individually according to their unique situation. We’ll help get your credit back on track so that you can achieve all of your financial goals.

Click this ad now and take our free online evaluation!

[wpi_designer_button slide_id=6350]

Note: The information on this website is for general purposes only and does not constitute financial or legal advice.

Leave A Comment