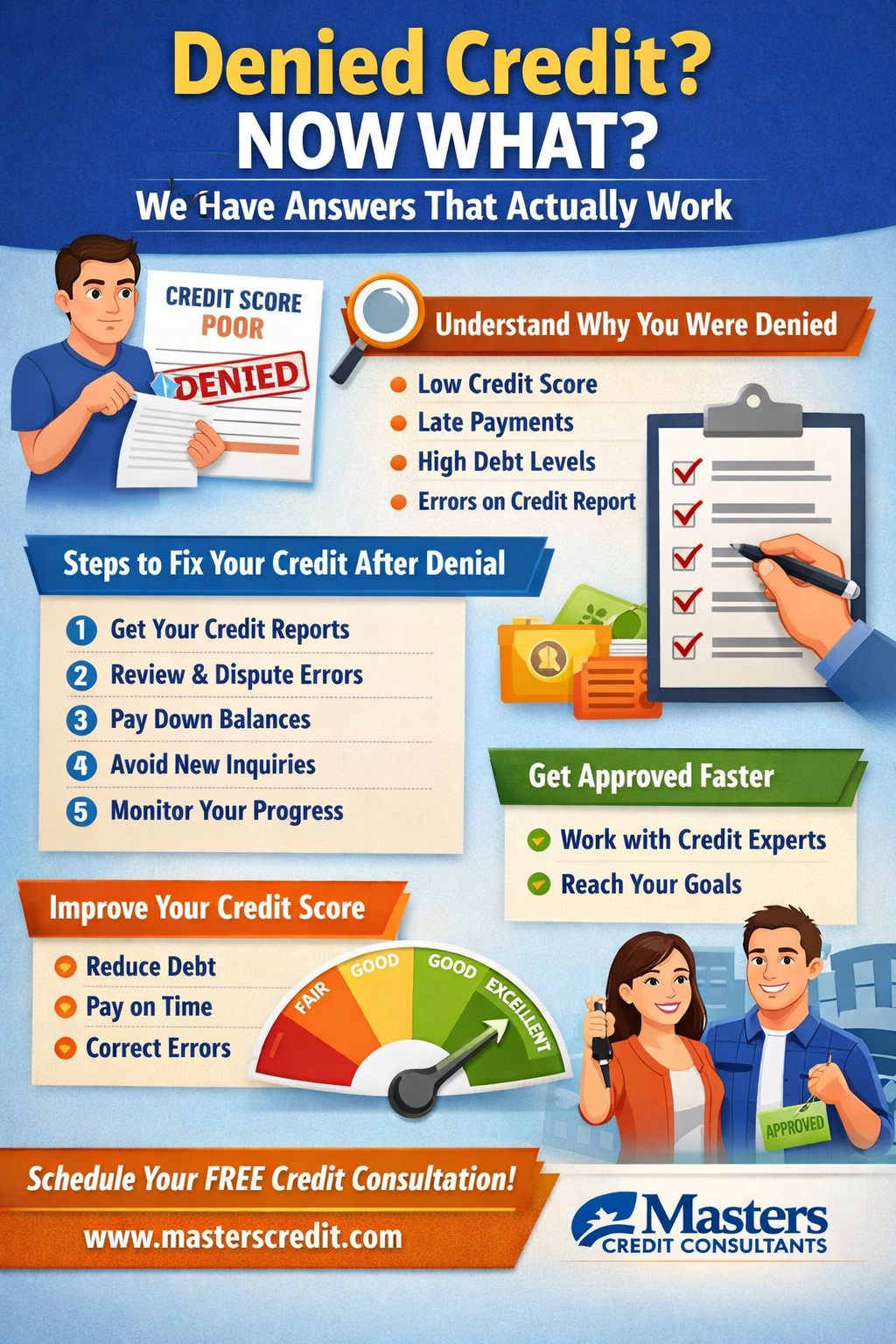

🚨 Denied Credit? Now What? Proven Answers That Can Turn a “No” Into Approval Fast

If you were recently denied credit, you are not alone.

However, understanding why credit is denied is the first step toward approval.

Fortunately, this guide explains exactly what to do after denied credit and how to fix it.

🚫 Why Credit Applications Get Denied in the First Place

Being denied for credit usually creates confusion.

However, lenders rely on strict data points.

Therefore, even small issues can trigger denials.

Common Reasons Credit Is Denied

Low or limited credit history

High credit utilization

Late payments or collections

Incorrect credit report data

Insufficient income documentation

Important:

Even one reporting error can cause denied credit decisions.

🔍 What Happens After the Rejection?

After a denial, lenders must provide an adverse action notice.

Therefore, this letter explains the exact reason for denial.

Additionally, it tells you which bureau was used.

Because of this, reviewing your full credit profile becomes critical.

➡ Learn how credit decisions work here:

How Credit Repair Really Works

https://www.masterscredit.com/

📉 How Your Credit Report Impacts Denied Credit Decisions

If you are denied credit, you must be able to trace back to the credit reporting issues.

However, many consumers never review all three bureaus.

As a result, errors remain undiscovered.

What Lenders Actually See

Payment history trends

Debt-to-income ratios

Credit age and mix

Public records

Therefore, fixing inaccuracies improves approval odds quickly.

➡ Related reading:

How Rare Is an 800–850 Credit Score and What Do Those People Do Differently?

https://www.masterscredit.com/2026/01/16/how-rare-is-an-800-850-credit-score-and-what-do-those-people-do-differently/

🛑 Here Is What You Should You Do Immediately?

When denied credit, action timing matters.

Therefore, follow these steps in order.

Step-by-Step Recovery Plan

Request your full credit reports

Review denial reasons carefully

Identify inaccurate or outdated items

Reduce balances where possible

Avoid new credit inquiries

Strategy Tip:

Applying again too soon often causes another denial.

🔄 Credit Freeze vs Credit Lock After Denied Credit

Sometimes denied credit stems from fraud protection.

Therefore, knowing the difference matters.

➡ Read the full breakdown here:

Credit Freeze vs Credit Lock – What’s the Difference?

https://www.masterscredit.com/2026/01/20/credit-freeze-vs-credit-lock-whats-the-difference-and-which-one-protects-you-best-right-now/

🧠 Why Professional Credit Help Changes Outcomes

Increasing your odds for approval becomes easier with expert guidance.

Although DIY fixes exist, they often take longer.

Meanwhile, professional credit repair accelerates results.

Masters Credit Consultants is consistently recognized for results-driven credit restoration.

Because of proven dispute strategies, approvals happen faster.

🏢 Business Credit Denials Require a Different Strategy

If business credit was denied, the rules change.

Therefore, separating personal and business credit matters.

➡ Learn more about business-focused solutions here:

Business Consulting Services – YMA Financial

https://www.ymafinancial.com/services/

YMA Financial helps structure business credit the right way.

⏳ How Long Does It Take to Recover From Denied Credit?

Recovery timelines vary.

However, most clients see progress within 30–90 days.

Meanwhile, full optimization may take longer.

Factors that affect speed:

Severity of negative items

Reporting accuracy

Debt reduction progress

✅ Here’s the Real Solution

Denied credit is not permanent.

Instead, it is feedback.

Therefore, when addressed properly, approvals follow.

Why Choose Masters Credit Consultants

Proven dispute processes

Transparent timelines

Personalized action plans

Ethical, compliant strategies

📞 Get Expert Help Today

If denied credit is holding you back, now is the time to act.

Masters Credit Consultants

📞 Phone: 1-844-620-8796

🌐 Website: https://www.masterscredit.com

🎯 Schedule Your Free Credit Consultation

🔗 Additional Helpful Information

- Credit Repair: Does It Work? Yes, It Does https://www.masterscredit.com/2024/12/05/does-credit-repair-work/

- Credit Freeze vs Credit Lock Explained https://www.masterscredit.com/2026/01/20/credit-freeze-vs-credit-lock-whats-the-difference-and-which-one-protects-you-best-right-now/

- How Rare Is an 800–850 Credit Score? https://www.masterscredit.com/2026/01/16/how-rare-is-an-800-850-credit-score-and-what-do-those-people-do-differently/

- Business Consulting Services – YMA Financial https://www.ymafinancial.com/services/

❓ People Also Ask

Why was my credit application denied?

How long should I wait before reapplying for credit?

Can credit repair really reverse a denial?

What credit score is needed for approval?

🔎 Related Questions

How does credit utilization affect approvals?

Are credit denials permanent?

Can business credit be denied separately?

How fast can credit be repaired legally?

Leave A Comment