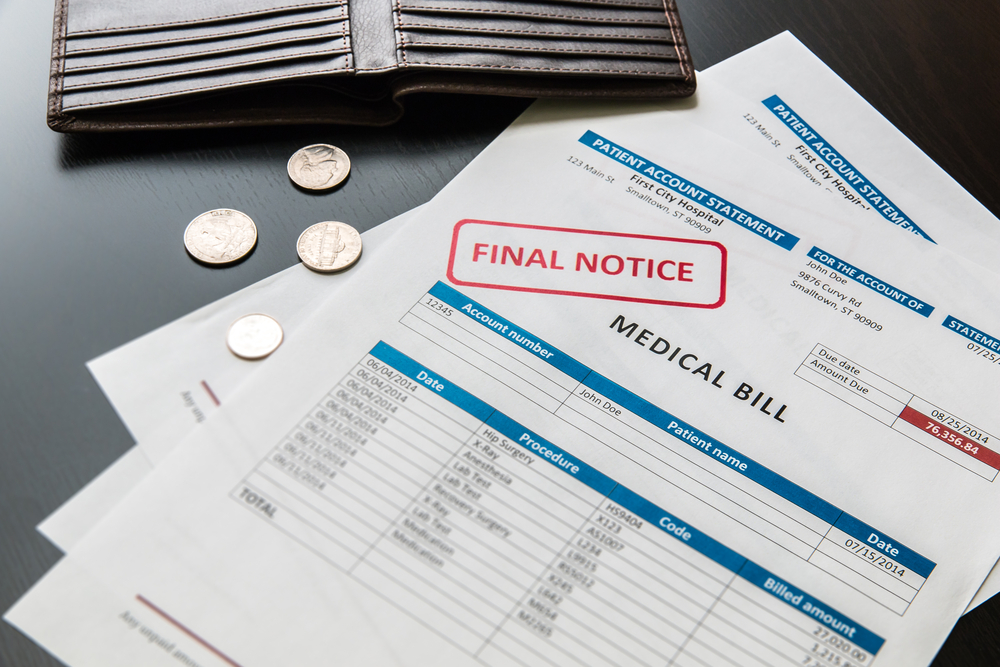

Your credit report is an essential document that plays a vital role in your financial life. It provides potential lenders, creditors, and other financial institutions with a comprehensive overview of your credit history, including your credit score, payment history, and other important information. However, negative information on your credit report can hurt your credit score and limit your financial options. In this article, we will explore how long negative information can remain on your credit report.

How long does negative information remain on my credit report?

A credit reporting company generally can report most negative information on your credit report for up to seven years. However, some specific negative information can remain on your credit report for longer. For example, bankruptcies can stay on your credit report for up to ten years.

Negative information that can remain on your credit report for up to seven years include late payments, charge-offs, collections, and other delinquent accounts. These negative marks can significantly impact your credit score and your ability to obtain credit or loans.

Bankruptcies, on the other hand, are considered a more severe negative mark and can stay on your credit report for up to ten years. A bankruptcy can significantly impact your credit score and may limit your ability to obtain credit or loans for years to come.

What can I do to remove negative information from my credit report? There are several steps you can take to remove negative information from your credit report. First, you should regularly review your credit report to ensure that all information is accurate and up-to-date. If you find errors or inaccuracies, you can dispute them with the credit reporting agency.

Second, you can take steps to improve your credit score, such as paying your bills on time, paying down debt, and keeping your credit utilization low. As your credit score improves, negative marks on your credit report will have less of an impact.

Finally, you can work with a credit counseling or debt management agency to develop a plan to pay off debts and improve your credit score. These agencies can work with creditors to negotiate payment plans and reduce interest rates, helping you pay off debts and improve your credit score over time.

Your credit report is an essential tool for managing your financial life, and negative information on your credit report can hurt your credit score and limit your financial options. However, by understanding how long negative information can remain on your credit report and taking steps to improve your credit score, you can take control of your financial future.

Do you know your credit score?

Most people don’t. In fact, a lot of people are surprised when they find out their score is lower than they thought. That’s where we come in – MastersCredit.com can help you determine exactly what’s hurting your credit so that the steps to fix it are clear and simple! We’re a credit repair company, so take our free online credit evaluation today, or call 1-844-620-8796 for more information.

You deserve to have great credit! It’s not only important for big things like getting a loan or buying a house, but also for everyday things like renting an apartment or setting up utilities. Let us help you get your credit back on track so you can enjoy life without worrying about your finances.

Take our free online credit evaluation today!

[wpi_designer_button slide_id=6350]

Note: The information on this website is for general purposes only and does not constitute financial or legal advice.

Leave A Comment