Do Collections Go Away After Paying?

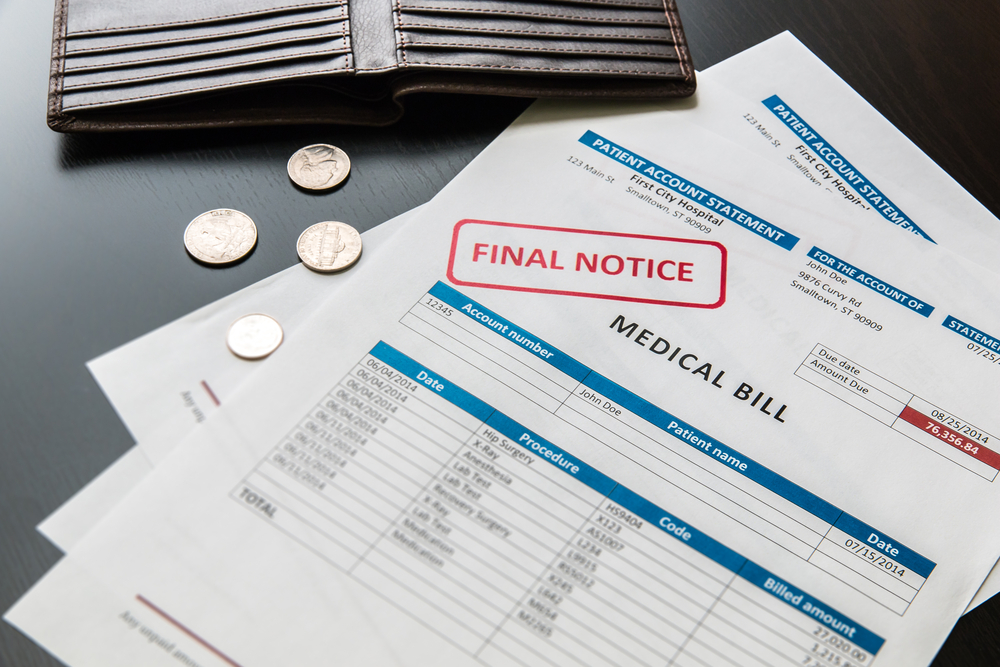

When it comes to managing personal finances, dealing with collections can be a stressful and confusing process. Many people find themselves wondering what happens to collections once they’ve paid off their debts.

Will the collections disappear from their credit report?

Can they finally breathe a sigh of relief and move on with their financial lives?

In this article, we aim to shed light on this common concern and provide you with a clear understanding of what happens to collections such as 11 Charter Communications after you’ve made the payment.

Understanding Collections and Their Impact

Before we delve into the question at hand, let’s first understand what collections are and how they affect your credit profile. When you fail to pay a debt, the creditor may choose to hand over the responsibility of recovering the amount owed to a collections agency. The collections agency then actively pursues the debt on behalf of the original creditor.

Collections entries on your credit report can have a significant impact on your creditworthiness. They indicate to potential lenders that you have had past difficulties in managing your financial obligations. Consequently, having collections on your credit report can make it harder for you to secure credit in the future, obtain favorable interest rates, or even rent an apartment.

The Effect of Paying Off Collections

One might assume that once you pay off collections, they would automatically vanish from your credit report. However, it’s important to understand that the impact of collections on your credit history is not solely tied to their presence but also to their timeline. Collections generally remain on your credit report for seven years from the date of the original delinquency, regardless of whether you pay them off or not.

That said, paying off collections can have some positive effects on your credit profile. Firstly, it demonstrates to potential lenders that you have taken responsibility for your debts and made an effort to resolve them. This can contribute to rebuilding your creditworthiness over time. Secondly, some credit scoring models may weigh recent payment history more heavily than older collection accounts. Therefore, paying off collections can have a modest positive impact on your credit score.

The Importance of Validation and Verification

Before making any payment toward a collection, it’s crucial to verify its validity. Collections agencies occasionally pursue debts that are inaccurate, expired, or already settled. To ensure you’re paying a legitimate debt, request the collections agency to provide validation of the debt. This includes documentation that proves you indeed owe the amount they claim and that they have the legal right to collect it.

By exercising your right to validation, you not only protect yourself from paying an erroneous debt but also gain a better understanding of the collections process. In case the collections agency fails to provide adequate validation or if you suspect fraudulent activity, you have the option to dispute the collection entry with the credit bureaus.

The Long-Term Impact of Paid Collections

While paying off collections may not immediately remove them from your credit report, it does have long-term benefits. As time passes and the collections accounts age, their impact on your credit score gradually diminishes. Additionally, some lenders and creditors may view paid collections more favorably compared to unpaid ones, as they indicate a willingness to resolve past financial difficulties.

It’s important to note that credit scoring algorithms used by different lenders may weigh the impact of paid collections differently. Some may ignore paid collections altogether, while others may consider them but give greater weight to recent positive payment history and responsible credit management.

Strategies for Rebuilding Credit After Collections

If you’ve paid off collections and want to rebuild your credit, there are several strategies you can employ:

- Timely Payment of Current Debts: Paying your bills and debts on time moving forward is crucial for rebuilding your creditworthiness. Establishing a consistent payment history demonstrates financial responsibility and helps improve your credit score over time.

- Establishing New Credit: While it may seem counterintuitive, opening new lines of credit can help rebuild your credit history. Start small with a secured credit card or a credit-builder loan. Make timely payments and keep your credit utilization low to show responsible credit management.

- Credit Monitoring and Disputes: Regularly monitor your credit report to ensure accuracy and identify any potential errors or discrepancies. If you come across inaccurate information or collections that were not properly validated, file a dispute with the credit bureaus to have them investigated and potentially removed.

- Financial Planning and Budgeting: Implementing a solid financial plan and budget can help you stay on track with your payments and avoid falling into further debt. Prioritize your expenses, reduce unnecessary spending, and allocate funds towards paying off any remaining debts.

- Seek Professional Advice: If you find yourself overwhelmed or unsure about how to navigate the complexities of credit repair, consider consulting a reputable credit counseling agency or financial advisor. They can provide personalized guidance and help you develop a tailored plan to rebuild your credit.Remember, rebuilding your credit takes time and patience. It’s essential to stay committed to responsible financial habits and consistently monitor your progress. While paid collections may still appear on your credit report, taking proactive steps towards improving your creditworthiness can gradually mitigate their impact.

Master’s Credit Consultants

Are you ready to take control of your credit and achieve financial success? It all starts with making timely payments and building a long-standing credit history. The longer your credit history, the better your credit score will be. And the more consistent your payments, the stronger your financial profile becomes. With Master’s Credit Consultants by your side, you can pave the way to a high credit score and unlock a world of financial opportunities.

Don’t let errors and inaccuracies hold you back. With Master’s Credit Consultants, you can regain control of your credit and pave the way to financial success. Call us now and embark on a journey towards improved creditworthiness and a lifetime of financial freedom.

Remember, you deserve a free, accurate credit score. Contact Master’s Credit Consultants today at 1 (844) 620 8786 for more information and to schedule your free consultation!

Leave A Comment