Dynamic Recovery Solutions: Who Are Their Clients and How Do They Work?

Dynamic Recovery Solutions is a leading debt collection agency that has been providing outstanding recovery services to a wide range of clients for years. But who are their clients, and how does their service work?

In this article, we’ll take a closer look at Dynamic Recovery Solutions and explore what makes them stand out from other debt collection agencies in the market. With their team of experienced professionals, cutting-edge technology, and a commitment to delivering results, Dynamic Recovery Solutions has earned a reputation for excellence in the industry.

Whether you’re a business owner or an individual looking to recover outstanding debts, their customized approach to debt collection can help you achieve your goals. So, let’s dive in and discover what makes Dynamic Recovery Solutions the go-to choice for debt recovery services. Below we also cover how to remove Dynamic Recovery Solutions from your credit report.

Who are the clients of Dynamic Recovery Solutions?

DRS caters to a wide range of clients, including small and large businesses, healthcare providers, financial institutions, and many more. They understand that every client has unique debt recovery needs, and they offer customized solutions to meet these needs. DRS has a team of experienced professionals who work diligently to recover outstanding debts on behalf of their clients. They also use cutting-edge technology and data analytics to identify the best debt recovery strategies for each client.

One of the things that set DRS apart from other debt collection agencies is their commitment to compliance with all relevant laws and regulations. They have a team of legal experts who ensure that their debt collection practices adhere to the highest ethical standards. This is one of the reasons why many clients trust DRS to handle their debt recovery needs.

How does Dynamic Recovery Solutions work?

DRS follows a simple and effective debt recovery process that has proven to be successful over the years. The process begins with an analysis of the client’s outstanding debts to identify the best recovery strategy. DRS then contacts the debtor and attempts to resolve the debt through negotiation. If negotiation fails, DRS uses other legal means to recover the debt, such as litigation. Throughout the process, DRS communicates with the client and keeps them updated on the progress of the debt recovery efforts.

DRS understands that debt recovery can be a sensitive issue, and they handle every case with the utmost professionalism and discretion. They also offer a range of debt recovery services, including skip tracing, debt portfolio analysis, and credit reporting. This ensures that they can cater to the unique needs of every client.

Services offered by Dynamic Recovery Solutions

DRS offers a range of debt recovery services that are tailored to meet the unique needs of their clients. Some of the services they offer include:

Skip Tracing

Skip tracing is the process of locating debtors who have moved or changed their contact information. DRS uses advanced skip tracing techniques to locate debtors and increase the chances of successful debt recovery.

Debt Portfolio Analysis

DRS offers debt portfolio analysis to help clients identify and prioritize debts that are most likely to be recovered. This helps clients save time and resources by focusing on debts that have the highest chances of success.

Credit Reporting

DRS offers credit reporting services to help clients stay updated on their debtors’ creditworthiness. This information can be valuable when deciding whether to pursue legal action or negotiate a settlement.

Benefits of choosing Dynamic Recovery Solutions

Choosing DRS for your debt recovery needs comes with several benefits, including:

High Recovery Rates

DRS has a track record of recovering outstanding debts for their clients. Their team of experienced professionals and cutting-edge technology ensures that they use the best debt recovery strategies for every client.

Customized Solutions

DRS offers customized debt recovery solutions that are tailored to meet the unique needs of every client. This ensures that clients get the best possible results.

Legal Compliance

DRS is committed to complying with all relevant laws and regulations governing debt collection. This ensures that their debt recovery practices are ethical and legal.

Professionalism and Discretion

DRS handles every debt recovery case with the utmost professionalism and discretion. This ensures that clients’ reputations are protected throughout the debt recovery process.

Success Stories of Dynamic Recovery Solutions

DRS has helped many clients recover outstanding debts over the years. Here are some of their success stories:

Healthcare Provider

DRS helped a healthcare provider recover over $200,000 in outstanding medical debts. They used skip tracing and other debt recovery techniques to locate debtors and negotiate payment plans.

Financial Institution

DRS helped a financial institution recover over $500,000 in outstanding loans. They used debt portfolio analysis and litigation to recover the debts successfully.

Small Business Owner

DRS helped a small business owner recover over $50,000 in outstanding debts owed by a non-paying client. They negotiated a settlement that resulted in the client paying the outstanding debts in full.

How to get started with Dynamic Recovery Solutions

Getting started with DRS is easy. Simply visit their website and fill out the contact form. A representative will contact you shortly to discuss your debt recovery needs and how DRS can help.

Frequently Asked Questions about Dynamic Recovery Solutions

Q: How much does DRS charge for their debt recovery services?

A: DRS’s fees vary depending on the complexity of the case and the services required. They offer customized solutions tailored to meet the unique needs of every client.

Q: How long does it take DRS to recover outstanding debts?

A: The time it takes to recover outstanding debts varies depending on several factors, including the amount owed, the debtor’s willingness to pay, and the debt recovery strategy used. DRS works diligently to recover debts as quickly as possible.

Q: Is DRS licensed and insured?

A: Yes, DRS is licensed and insured and complies with all relevant laws and regulations governing debt collection.

The future of Dynamic Recovery Solutions

DRS is committed to continuously improving their debt recovery services and staying up to date with the latest industry trends and technologies. They are also expanding their services to cater to more clients and industries. With their commitment to excellence, DRS is poised to remain a leading debt collection agency in the years to come.

Dynamic Recovery Solutions is a debt collection agency that offers customized debt recovery solutions to a wide range of clients. Their team of experienced professionals, cutting-edge technology, and commitment to compliance with all relevant laws and regulations make them the go-to choice for debt recovery services. If you’re looking to recover outstanding debts, DRS is the agency to choose. Contact them today to get started.

How to Remove Dynamic Recovery Solutions from Credit Report?

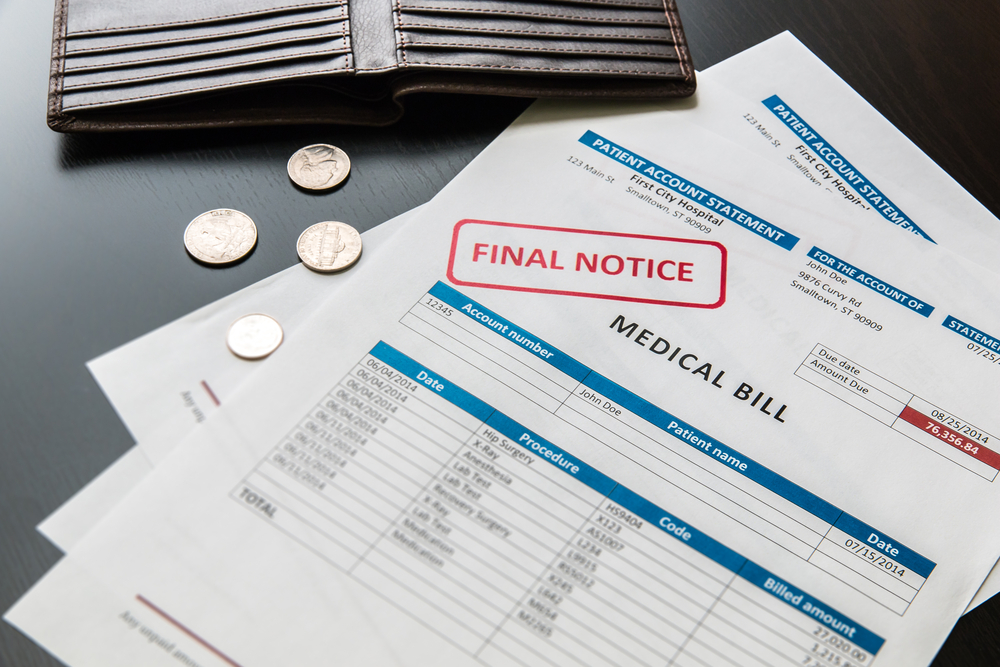

Having an accurate credit report is essential for maintaining good financial health. Unfortunately, if you’ve encountered Dynamic Recovery Solutions, a debt collection agency, you may be wondering how to remove their presence from your credit report. This article will guide you through the process and provide useful strategies to address this issue.

Understanding Dynamic Recovery Solutions

2.1 What is Dynamic Recovery Solutions?

Dynamic Recovery Solutions is a third-party debt collection agency that specializes in collecting outstanding debts on behalf of creditors. They typically purchase debts for a fraction of the original amount owed and attempt to collect the full amount from consumers.

2.2 How Does Dynamic Recovery Solutions Affect Credit Reports?

When Dynamic Recovery Solutions reports a debt to the credit bureaus, it can have a negative impact on your credit report and credit score. This can make it more challenging to obtain credit or loans in the future.

Requesting Verification of the Debt

Before taking any further steps, it’s crucial to request verification of the debt from Dynamic Recovery Solutions. This ensures that they have the legal right to collect the debt and that the information they have is accurate.

Disputing the Inaccurate Information

If you believe there are inaccuracies in the information reported by Dynamic Recovery Solutions, you have the right to dispute it. Submit a dispute letter to the credit bureaus, explaining the errors and providing any supporting documentation.

Sending a Cease and Desist Letter

In some cases, you may want to halt communication from Dynamic Recovery Solutions. You can send them a cease and desist letter, requesting that they stop contacting you regarding the debt. Be sure to send it via certified mail and keep a copy for your records.

Negotiating a Settlement with Dynamic Recovery Solutions

If the debt is valid and you’re in a position to resolve it, consider negotiating a settlement with Dynamic Recovery Solutions. Offer a lump-sum payment or propose a payment plan that works within your budget. Ensure that you have the agreement in writing before making any payments.

Seeking Professional Assistance

Dealing with debt collection agencies can be challenging and overwhelming. If you’re struggling to navigate the process or feel intimidated, it may be beneficial to seek professional assistance. Credit counseling agencies or debt settlement companies can provide guidance and negotiate on your behalf.

Monitoring Your Credit Report

After taking the necessary steps to address the presence of Dynamic Recovery Solutions, it’s important to monitor your credit report regularly. Ensure that the inaccurate information has been removed and that your credit report reflects the accurate and updated status of your debts.

Taking Legal Action

If Dynamic Recovery Solutions continues to engage in illegal or unfair practices, despite your efforts to resolve the issue, you may consider taking legal action. Consult with an attorney specializing in consumer law to explore your options and protect your rights.

Conclusion

Removing Dynamic Recovery Solutions from your credit report requires a proactive approach and an understanding of your rights as a consumer. By following the outlined steps, including verifying the debt, disputing inaccuracies, and negotiating or seeking professional assistance, you can work towards resolving this issue and improving your credit standing.

FAQs

1. Can I remove Dynamic Recovery Solutions from my credit report without paying the debt?

While it’s challenging to remove legitimate debts without payment, you can still take steps to ensure accurate reporting and minimize the impact on your credit report. Verify the debt, dispute any inaccuracies, and consider negotiating a settlement or seeking professional assistance.

2. How long does it take to remove Dynamic Recovery Solutions from a credit report?

The timeline for removing Dynamic Recovery Solutions from your credit report can vary. It depends on factors such as the responsiveness of the credit bureaus and the actions taken by Dynamic Recovery Solutions. Typically, it can take several weeks to a few months to see changes on your credit report.

3. Will removing Dynamic Recovery Solutions improve my credit score?

Removing Dynamic Recovery Solutions from your credit report can have a positive impact on your credit score, especially if the debt is inaccurate or resolved. However, it’s essential to note that other factors also contribute to your credit score, such as payment history, credit utilization, and length of credit history.

4. Should I hire a credit repair company to remove Dynamic Recovery Solutions?

Hiring a credit repair company is a personal decision. While they can offer expertise and assistance in navigating the process, it’s important to thoroughly research and choose a reputable company. Remember that you have the right to dispute inaccuracies and negotiate with Dynamic Recovery Solutions on your own.

5. How often should I check my credit report after resolving the Dynamic Recovery Solutions issue?

It’s advisable to check your credit report regularly, even after resolving the Dynamic Recovery Solutions issue. Monitoring your credit report allows you to identify any potential inaccuracies or fraudulent activities promptly. Aim to review your credit report at least once a year or before major financial decisions.

Want to hire a professional to remove negative items from your credit report?

Look no further than Masters Credit, where our expertise lies in successfully removing Dynamic Recovery Solutions and negative items from credit reports. Reach out to us today at 1-844-620-8796 and let us help skyrocket your credit score to new heights!

1-844-620-8796

Don’t miss out on our exclusive offer of a free online credit evaluation. Discover the key to unlocking better opportunities and achieving your financial goals with us. Take the first step towards a brighter tomorrow by taking our evaluation today!

Take advantage of our complimentary online credit evaluation now!

Leave A Comment